Join the world’s largest virtual bank account network

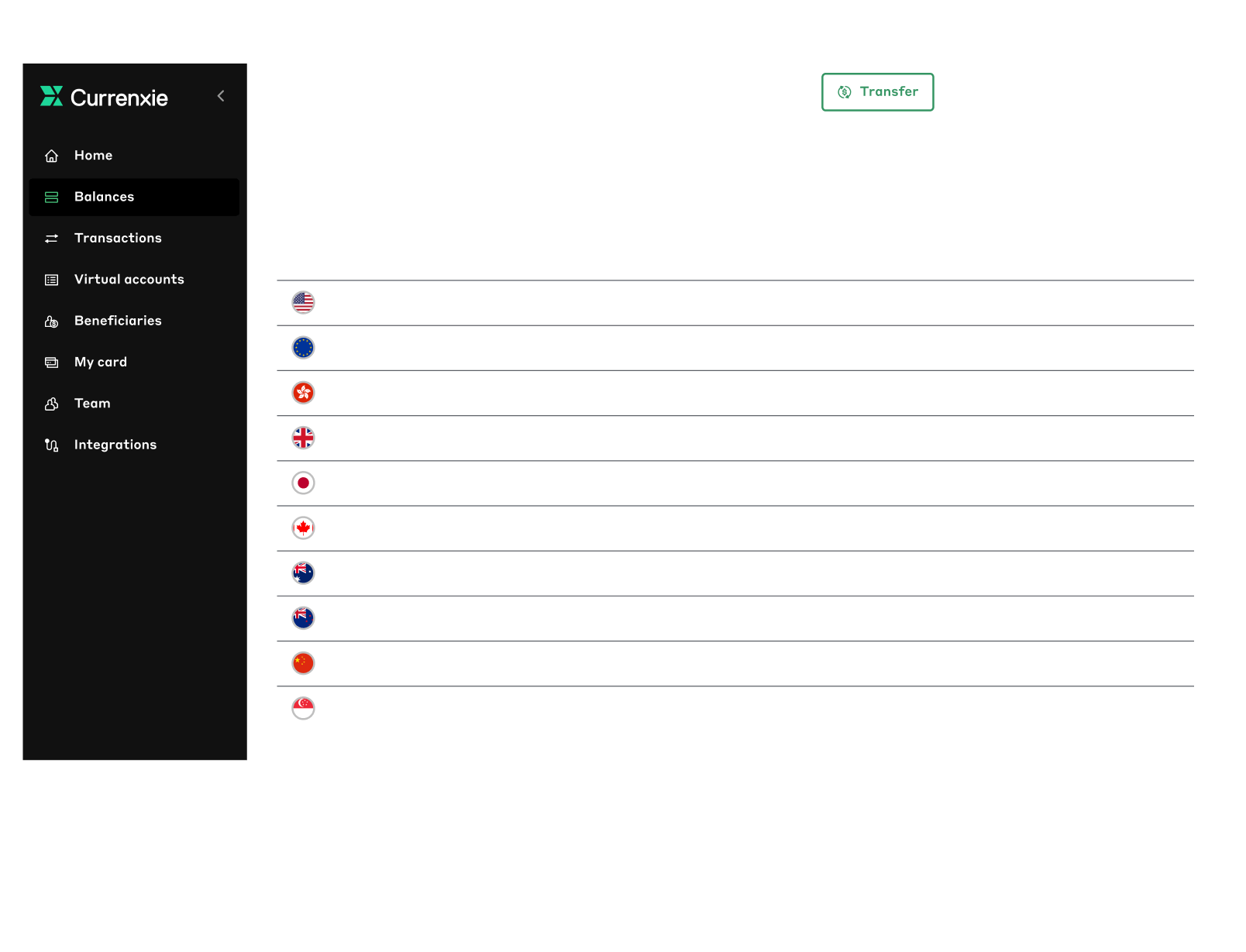

One account, global reach

Access and make cross-border payments from a single multicurrency platform.

Fast and simple multi-currency transfers

Convert funds on your own terms, saving up to 8x more than traditional banks.

Fixed fees across the board

Drastically reduce cross-border and FX fees with transparent pricing and mid-market rates.

No integrations required

Easily connect to payment gateways and marketplaces.

The fastest way to transfer funds globally for less

How it works

Get connected

Apply online and get instant access to unique bank account numbers covering 40+ countries.

Start transacting

Send and receive funds in 20+ currencies, including USD, EUR, GBP, HKD, SGD, JPY, IDR, AUD, CAD, RMB and more.

Maximise savings

With genuine mid-market FX rates - no hidden spread - and transparent pricing, you can save up to 8x versus traditional banks.

Transparent pricing

Know what you'll get in advance. Our pricing is clear and transparent - always. Learn more

Easily collect from marketplaces and payment gateways

As seen in

“As the world’s leader in digital payments, Visa is delighted to partner with Currenxie. Our joint efforts can meet the evolving needs of businesses in dealing with cross-border payments and help optimise their operations.”

“Businesses of all sizes, from all corners of the globe, can move swiftly into new markets without burdensome fees and restricted access to fundamental payment services.”

“With Currenxie, customers don’t need to keep up with the pace of innovation in payments tech because the company does that for them.”

“With their many decades’ worth of experience, the Currenxie team has developed an impressive plan for the future of payments – one that will capture the global growth in eCommerce.”

FAQs

A Global Account gives you access to Currenxie's global bank account network. All of the accounts in our network support local payments, which tend to be faster and cheaper. Local payments are when the sender and receiver are in the same jurisdiction and using the same currency and settlement system.

We support receiving local payments as follows:

- USD to an account in the United States

- EUR to an account in the Eurozone

- GBP to an account in the United Kingdom

- HKD to an account in Hong Kong

- SGD to an account in Singapore

- IDR to an account in Indonesia

- AUD to an account in Australia

- CAD to an account in Canada

We support sending local payments as follows:

- USD to an account in the United States

- EUR to an account in the Eurozone

- GBP to an account in the United Kingdom

- HKD to an account in Hong Kong

- IDR to an account in Indonesia

- AUD to an account in Australia

- CAD to an account in Canada

- INR to an account in India

- THB to an account in Thailand

- VND to an account in Vietnam

- ZAR to an account in South Africa

Additionally, our Hong Kong multi-currency accounts support sending and receiving international SWIFT payments to and from 100+ countries in all of these currencies:

AUD, CAD, CHF, CNH (CNY), DKK, EUR, GBP, HKD, JPY, NOK, NZD, SEK, SGD and USD.