Guides

Five Fintech Solutions Helping Close the Asian SME Trade Gap

22.12.2020

When it comes to cross-border trading, access to trade finance is a crucial component for any entrepreneur if they want to succeed. Exporters expect to be paid upon shipment, while importers require cash upfront when goods are received, creating a time gap that’s threatened by the risk of non-payment.

Historically, traditional banks stepped in to cover this risk by offering credit through trade finance. In fact, today it’s estimated that 80% of global trade is covered by some form of credit. However, as SMEs continue to account for the majority of businesses worldwide, the number of incumbent banks offering to give them trade finance is fast-decreasing, resulting in what’s known as the SME Trade Gap.

Estimated at a staggeringly high US$1.5 trillion globally, the trade finance gap is growing amid ongoing economic uncertainty caused by the COVID-19 pandemic. SMEs are the hardest hit by the challenges of obtaining trade finance, with the World Economic Forum (WEF) estimating this gap could reach US$2.5 trillion by 2025.

The Biggest Challenges Faced by Asian SMEs

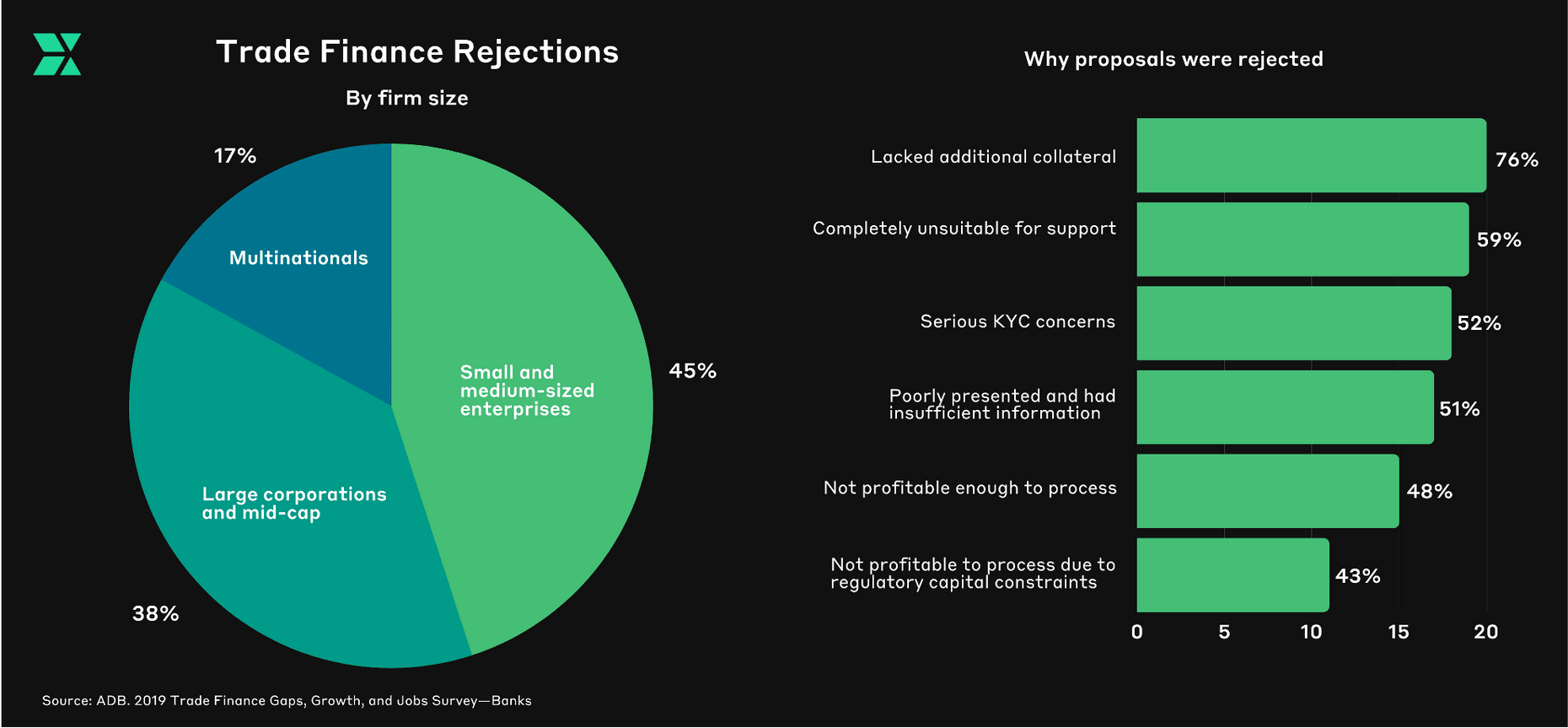

According to a recent report, 45% of trade finance applications by SMEs are rejected by banks, compared to 38% for medium to large-sized firms and 17% of multinational corporations. However, a banking survey showed that only 20% of rejected SME applications were actually ‘unbankable’.

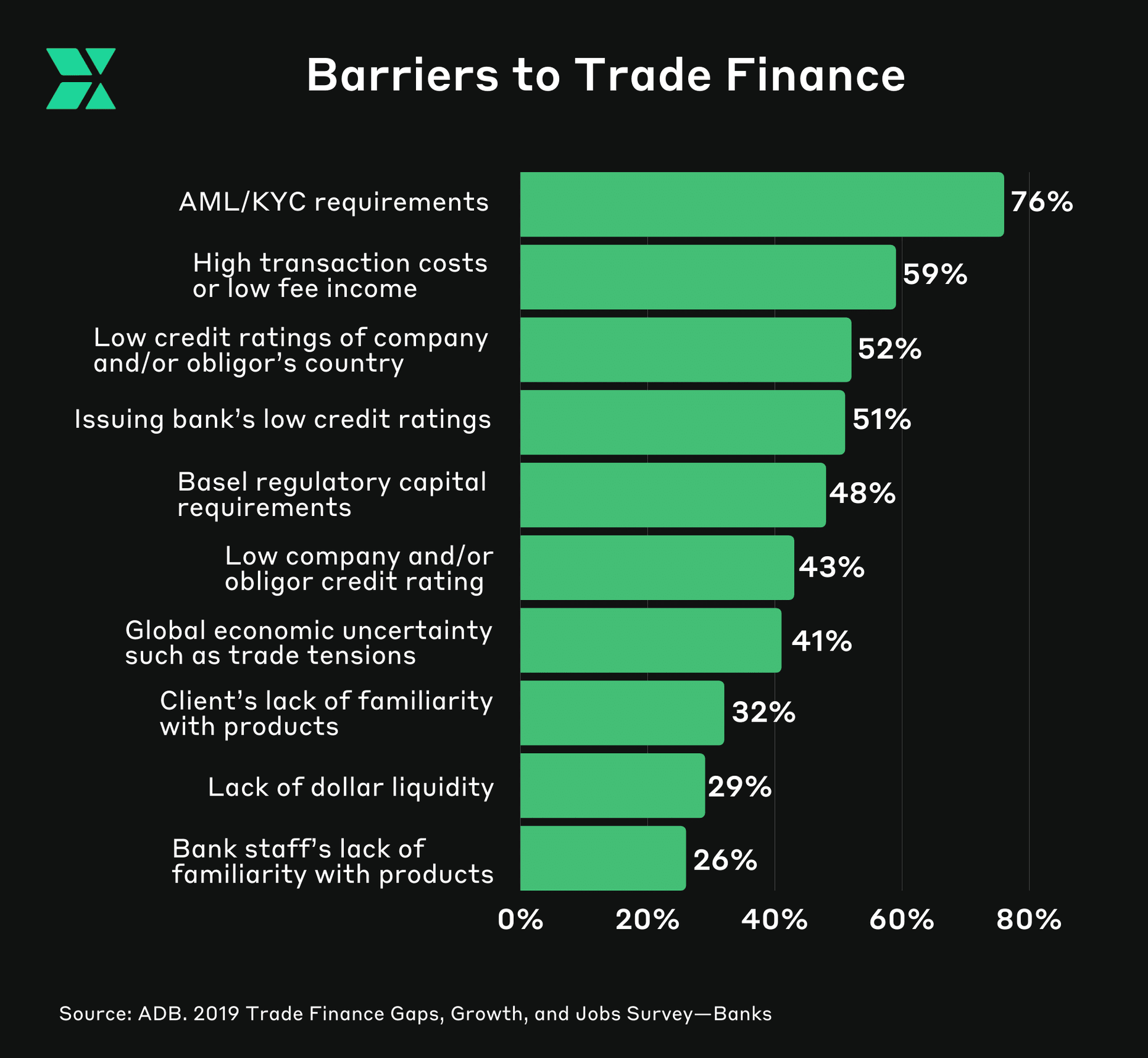

Anti-money laundering (AML) and know-your-customer (KYC) compliance regulations are the biggest obstacles for smaller businesses when receiving approval for trade finance. While these regulations are crucial to counter the financing of terrorism or money laundering, incumbent banks end up inadvertently cutting off legitimate companies from the financial support they need to grow.

The ongoing pandemic that’s triggered constant lockdowns and restrictions has caused traditional brick-and-mortar retailers to suffer the most. Online sales are booming — especially in the APAC region, where the COVID-19 crisis has given way to eSellers expanding into other sectors previously dominated by physical stores. This has spurred a greater need for SMEs to have access to trade finance, however, banks are rejecting more applications than ever before due to cost constraints caused by economic uncertainty.

A recent study determined that SMEs account for 90% of businesses worldwide, and more than 50% of employment. According to Filippo Buzzi, Head of Italian Desk and Blockchain Desk at FIDINAM, “SMEs in Asia are acting as an engine of growth for the global economy. However, they are faced with short-term bank lending, shallow capital markets, a shortage of long-term investors and a lack of financial data and credit expertise — meaning that they’re unable to access appropriate forms of finance and capital as most have no clear property rights and collateral assets.”

Fortunately, there is a way to bridge the gap. By leveraging the services primarily offered by fintech companies, SMEs can access trade financing, which will subsequently help empower them to contribute to the pandemic-battered global economy.

Bridging the Gap Through Digitisation

Fintech companies have been revolutionising the payments industry since the 2008 financial crisis, and have recently ventured into the trade finance space through online lending platforms as digital trade finance becomes more sought after.

Fintechs are becoming a catalyst for expanding global trade by helping SMEs significantly reduce costs and bureaucracy. By offering alternate forms of financing globally in real-time, these platforms are known to approve applications in a matter of weeks as opposed to the traditional route that used to take months.

In addition to fast reviews and approvals, applications can be done entirely online — there’s no need for physical meetings or office visits. “This further incentivises digitalisation due to the spread of COVID-19, where trade financing for SMEs doesn’t have to be affected by social distancing or lockdown measures,” says Filippo.

The rise in fintech trade financing can predominantly be seen in the APAC region. The alternative finance market in the Asia-Pacific has more than doubled between 2015 and 2016 and grew a further 69% from 2017 to 2018, with China accounting for 99% of the overall APAC market volume. Other key markets in the region include Hong Kong, Indonesia, Malaysia, the Philippines, and India.

A Fine Alternative

Trade finance is an umbrella term for businesses looking to finance the export or import of goods in both domestic and international markets. Filippo explains, “Trade finance may be used to protect against international trade’s unique inherent risks, such as currency fluctuations, political instability, issues of non-payment, or the creditworthiness of one of the parties involved.”

Bank loans, overdrafts, Letter of Credits (LCs), export credit and insurance are considered traditional forms of debt finance primarily offered by incumbent banks. However, new fintech alternatives that assist in cross-border trade come in the form of:

- Invoice Financing: Helping business operations by providing companies with immediate cash flow, invoice financing sees an invoice being sold to a third party business after goods were sold or serviced rendered.

- Receivables Financing: When a business issues invoices that refer to purchases made, but they have yet to receive payment, they can rely on receivables financing. However, it depends on which side of the invoice you look at. Accounts payable means that the company owes money to a supplier, whereas accounts receivable refers to money owed to the organisation.

- Asset Finance: Ideal for SMEs that have poor cash flow, asset finance can help companies make up-front payments in full when buying the assets they need, but can’t necessarily afford, to take their businesses off the ground.

- eCommerce Financing: Before the pandemic caused it to skyrocket by 209%, the eCommerce industry was growing at over 30% per annum. Short-term loans empower eSellers by providing them with the working capital they need to cover supplier payments, often using their inventory/receivables as collateral.

- Invoice Factoring: SME suppliers of goods and services need invoice factoring to convert sales into cash. They do this by selling their unpaid invoices to a third party company. When the invoice is sold, the third-party pays the business a percentage of the total amount and takes full responsibility for collecting payment from the buyer.