Guides

What Are SWIFT Payments: Everything You Need to Know

4.01.2022

If you’ve sent funds abroad or work in an industry that executes international payments, you know that most of these international transfers are carried out via the SWIFT network. And, while this process sounds fast, the acronym is proving to be a misnomer — SWIFT transfers tend to be anything but and often incur high costs.

Spending time to educate yourself on the basics of SWIFT will not only help you (and your business) navigate the international payment ecosystem, but it will help lay the foundation in understanding how solutions like Currenxie are creating a better alternative for cross-border payments, awarding your businesses with more affordable options without you having to sacrifice security.

What Exactly is SWIFT?

SWIFT — or the Society for Worldwide Interbank Financial Telecommunication — is the dominant facilitator for international transactions. Essentially an electronic payment messaging system, SWIFT enables wire transfers by facilitating codes across its global network of intermediary banks.

Considered the gold standard for reliable and secure financial transactions, SWIFT is used by over 11,000 institutions across 200 countries today. In January 2021 alone, member institutions sent approximately 42.1 million transactions per day through the network.

However, despite these figures, more and more people are deeming SWIFT to be outdated, slow and expensive and are instead opting for more streamlined, affordable options.

How Does a SWIFT Payment Work?

There is a popular misconception that the SWIFT network transfers money from Bank A to Bank B. However, it does not perform electronic fund transfers (i.e. money is not moved from one country to another). Instead, SWIFT passes messages between banks in a secure manner that enables a worldwide network of financial institutions to exchange funds.

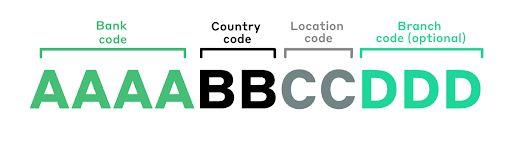

It does this by assigning each financial organisation in its network a unique code that has either eight or 11 characters. The code is called the bank identifier code (BIC), SWIFT code, SWIFT ID or ISO 9362 code (they essentially mean the same thing).

For example, if you have a bank account with HSBC in Hong Kong and you want to send money to your supplier who banks at the Standard Bank branch in Cape Town, South Africa then all you need to do is:

- Walk into your local HSBC branch in Hong Kong, or log in online, with your supplier’s account number and Standard Bank’s unique SWIFT code for its Cape Town branch (SBZAZAJJATG)

- HSBC will send a payment transfer SWIFT message to the Standard Bank branch over the secure SWIFT network

- Once Standard Bank receives the SWIFT message about the incoming payment, it will clear and credit the money to your South African supplier’s account

Again, while this process sounds relatively seamless, SWIFT transfers can take days — sometimes weeks — to reach their destinations with banks rarely warning their customers of potential delays. Sending wire transfers via your bank’s SWIFT global network of intermediary banks can also be incredibly costly.

The Problem with SWIFT

-

Time. SWIFT transfers typically take 24 to 48 hours to complete. Depending on the complexity of the transfer, however, they can take up to five business days due to a host of compliance checks carried out by intermediary banks. You also need to manually input your receiver’s banking details each time you want to facilitate a payment, which can be quite laborious.

-

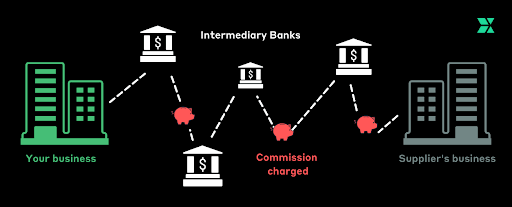

Cost. Currency conversions that trigger a foreign exchange rate that is typically 4-6% above the interbank FX rate (the one you see on Google) will likely result in a small fortune in hidden charges.

Once your transfer is initiated, your funds also get routed through multiple intermediary banks that each charge a commission. Not only does this cost you more money, but it also puts your transfer at greater risk of being lost or delayed.

-

Delays. Due to frequent communication issues between banks, these are more common than not. Should you send money abroad using the incorrect BIC/SWIFT code, your funds could get lost somewhere in the international banking network. When this happens, it typically takes weeks to relocate them because most banks are unlikely to let you have the MT103* for your specific transfer unless you pay a US$25 fee.

*An MT103 is a globally-accepted proof of payment. It includes all of the payment details for your SWIFT transfer, including date, the amount, currency, sender and recipient. An MT103 is also essential for tracking down payments that go missing or are delayed, as they map the payment route between banks.

-

Additional costs. Should your payment go missing, you’re likely to incur a charge. Your suppliers and staff will also be forced to wait for payment, which could affect your business operations.

Fortunately, there’s a faster, easier, and more affordable way to make cross-border remittances.

Bypass the SWIFT Network

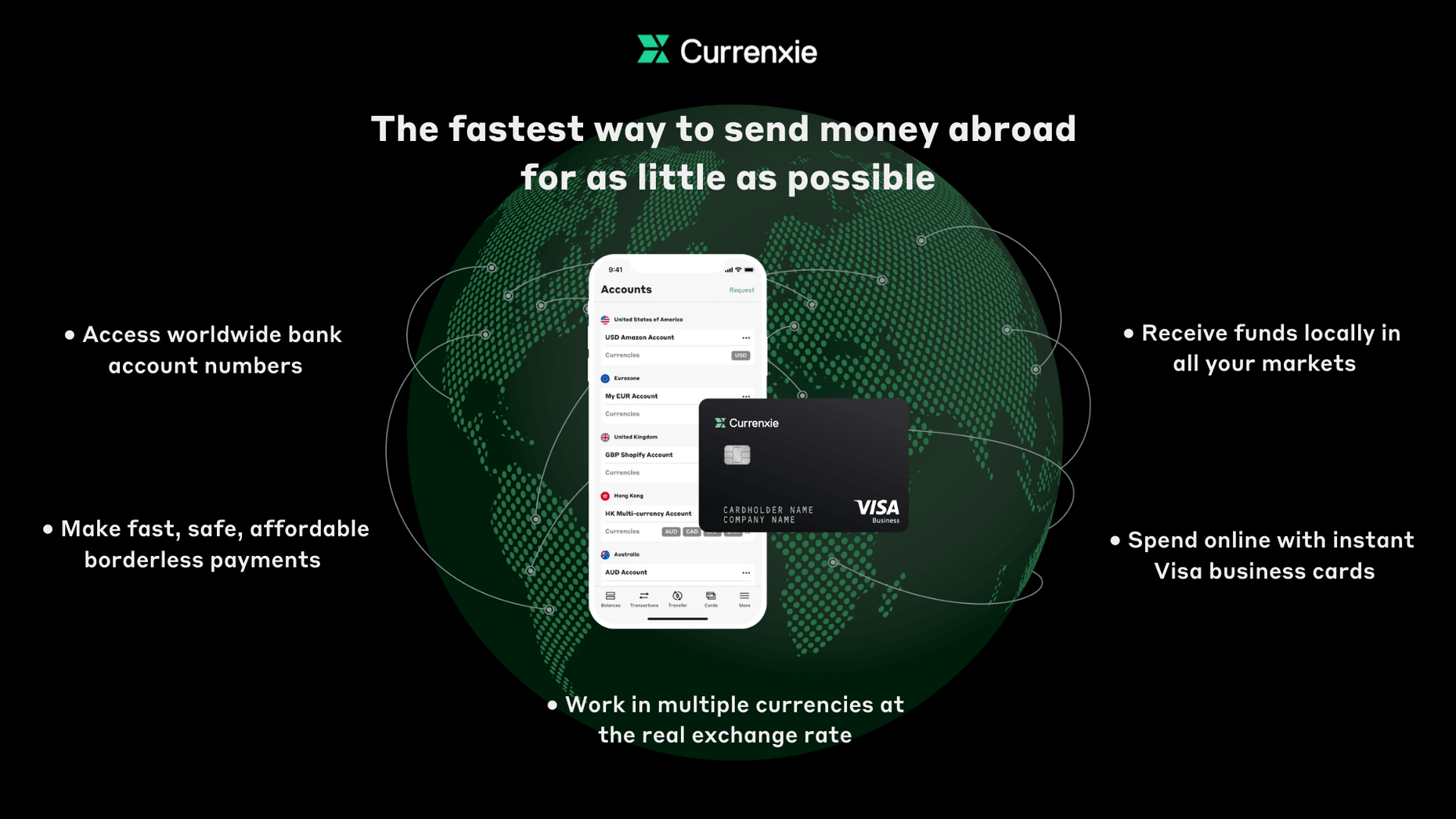

While SWIFT revolutionised the industry, it has yet to receive a much-needed upgrade to match the needs of today’s global organisations. This gap has given way to fintech institutions like Currenxie to transform the way businesses conduct cross-border remittances — offering an ideal alternative to SWIFT.

Through our Global Account platform, Currenxie enables companies to bypass the SWIFT network — and cross-border payments entirely — to make payments significantly faster and more affordable.

How do we do this? Rather than sending payments cross-border, we connect directly with banks and settlement systems locally in each country. For example, a Currenxie client could receive a payment in Australia and then make a payment in the UK, and both would be ‘local’ payments. This means they are much cheaper and processed the same day — often the same hour or minute.

Today, Currenxie operates one of the largest networks of virtual bank accounts globally. We support the receiving of local payments as follows:

- USD to an account in the United States

- EUR to an account in the Eurozone

- GBP to an account in the United Kingdom

- HKD to an account in Hong Kong

- SGD to an account in Singapore

- JPY to an account in Japan

- IDR to an account in Indonesia

- AUD to an account in Australia

- CAD to an account in Canada

And we support the sending of local payments as follows:

- USD to an account in the United States

- EUR to an account in the Eurozone

- GBP to an account in the United Kingdom

- HKD to an account in Hong Kong

- JPY to an account in Japan

- IDR to an account in Indonesia

- AUD to an account in Australia

- CAD to an account in Canada

- INR to an account in India

- THB to an account in Thailand

- VND to an account in Vietnam

- ZAR to an account in South Africa

If you still need to make a SWIFT payment to a country outside of Currenxie’s network, that’s no problem. Our Hong Kong multi-currency accounts support the sending and receiving of international SWIFT payments to and from 100+ countries — and still at a far lower cost than a traditional bank.

Want to save time, money, and access global commerce? Sign up for your free Currenxie Global Account today.