Guides

An Easy Guide to Understanding Hong Kong’s Tax System

16.09.2021

Hong Kong boasts one of the most comprehensive, simplest and cheapest tax payment systems in the world. Value-added tax, withholding tax, estate tax, dividend tax, sales tax, inheritance tax, tax on interest and capital gains tax are non-existent which makes the special administrative region an ideal shopping hub and financial base for companies and workers alike.

This is partially due to the Hong Kong government’s large fiscal reserves that make up more than 12 months of expenditure. The interest earned on these reserves helps lighten the city’s tax burden.

To protect Hong Kong’s low-tax system, two articles were introduced when the Basic Law was drafted in 1990 that sees the Special Administrative Region practice an independent taxation system from that of Mainland China. This means that as an independent public finance system, Hong Kong doesn’t have to hand tax revenue to the central government in Beijing.

How Hong Kong’s Tax Compares

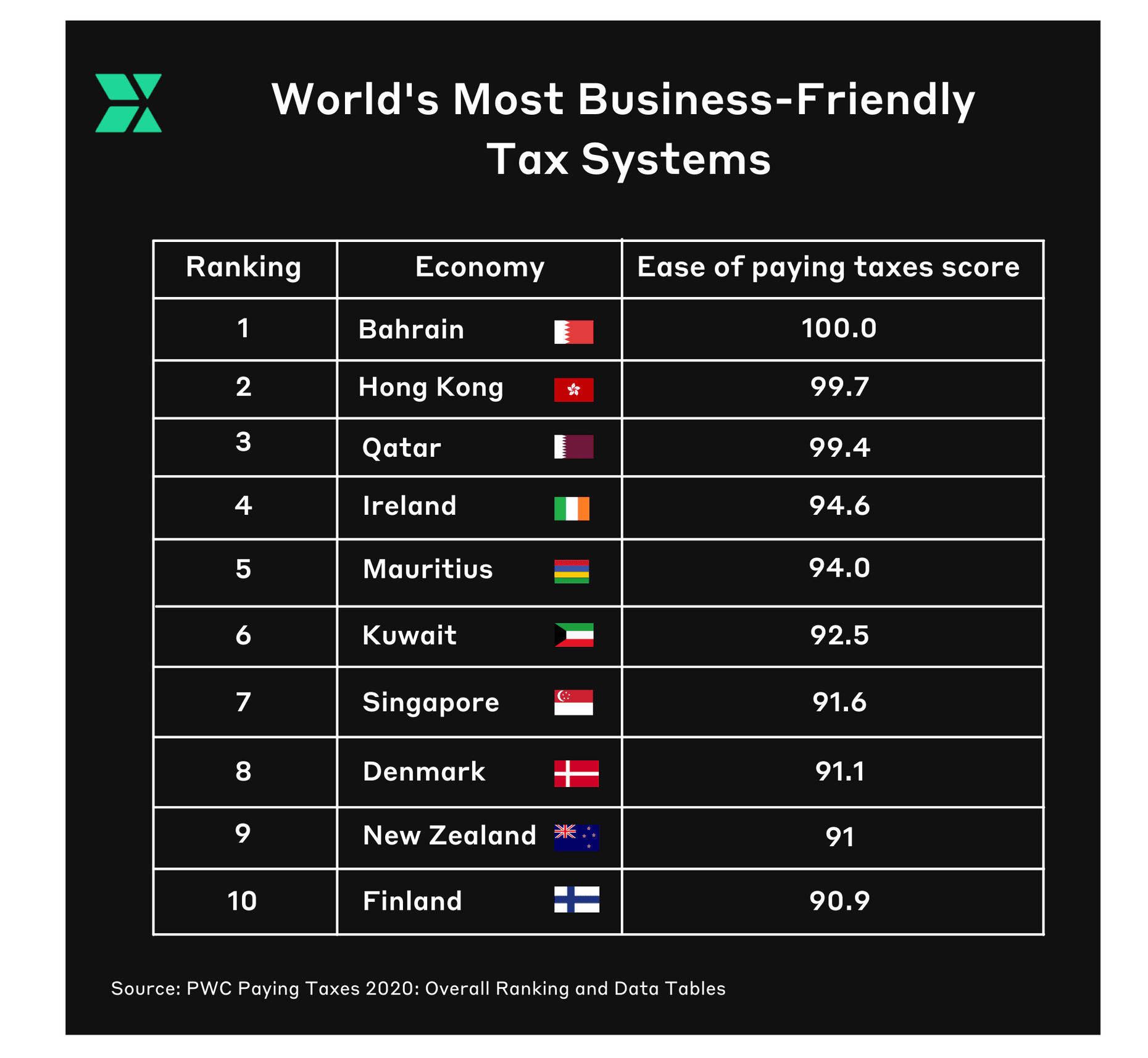

A recent PWC ranking of 190 tax jurisdictions declared Hong Kong the second-most business-friendly tax system in the world after Bahrain and followed by Qatar and Ireland respectively.

In Hong Kong, taxation is proportional to income. Therefore, the city’s highest earners pay the most, whereby low-income households are taxed the least. For example, those who earn less than HK$40,000 a year only need to pay 2% tax compared to the 17% tax for those who earn HK$120,000 or more.

It’s also interesting to note that tax isn’t a primary source of revenue for the Hong Kong government. Instead, as the city owns most of its land, it makes its money by selling and leasing it. In 2018, 27% of Hong Kong’s $612 billion revenue came from land sales.

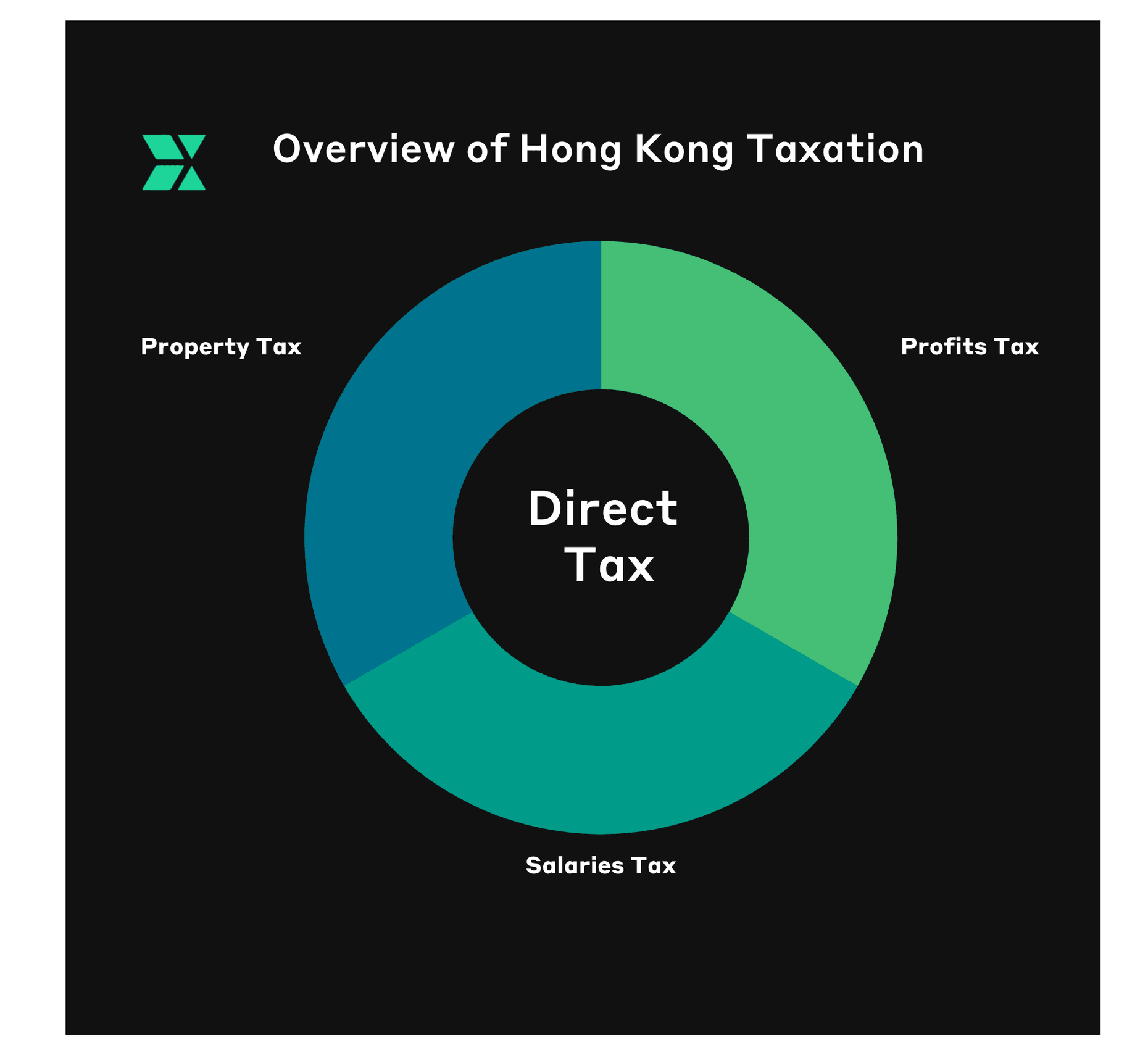

Hong Kong’s Tax System

There are three main types of tax that fall under the Inland Revenue Ordinance (IRO). These are profits tax, salaries tax and property tax. Major levies include stamp duty, customs and excise duty, betting duty and hotel accommodation tax. Fun fact: Hong Kong removed all duties on alcohol, except for spirits, in 2008.

1. Profits Tax

Also known as taxation for business, if you are a corporation, partnership, trustee, a person carrying out a trade or business in Hong Kong then you are subject to profits tax. Foreign companies who conduct business in Hong Kong are subject to this type of tax as well.

As Hong Kong operates a territorial system of taxation, you will only be taxed on the income and profits that you earned in the jurisdiction. This is the case for over 40 countries that have Double Taxation Agreements with Hong Kong.

If you’re concerned about double taxation and aren’t sure if your income is taxable in Hong Kong, the Inland Revenue Department (IRD) has come up with a series of questions you should ask yourself:

- Is your office that does all the work to make a profit located in Hong Kong?

- Is the work that is most relevant to generating the profit done in Hong Kong?

- Are the business decisions associated with making a profit made in Hong Kong?

- Does the money you earn come from Hong Kong entities?

- Is your main office that carries out the work and decisions in Hong Kong?

If you answered “yes” to any of the questions above, you will likely need to pay tax in Hong Kong.

If you would like profits to be exempt from tax based on the territorial principle, the IRD may likely request additional documents to support your claim. They have the final say on whether your profits should be taxed in Hong Kong.

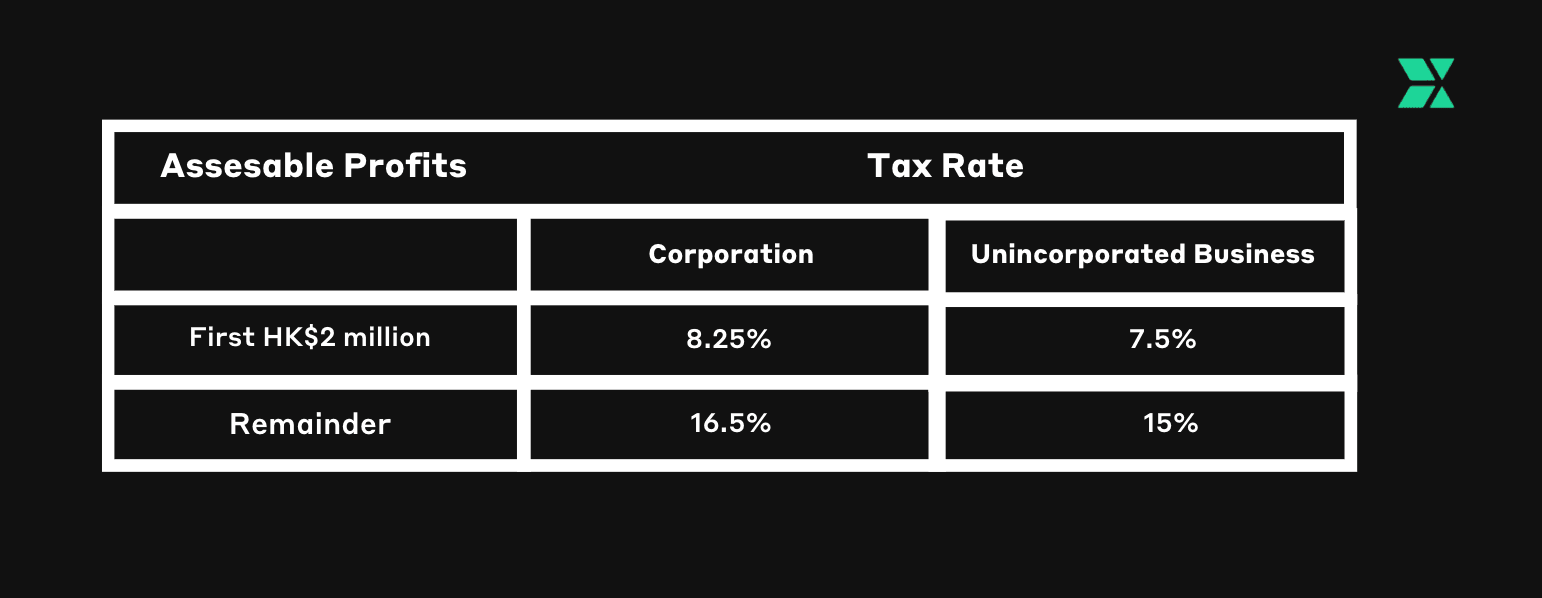

Rates:

For the first HK$2 million of assessable profits, corporations are charged a tax rate of 8.25%. For all remaining profits, corporations need to pay a statutory 16.5%. Conversely, for unincorporated businesses (i.e. partnerships and sole proprietorships), the two-tiered tax rates are set at 7.5% and 15%.

Tax Year: Tax is charged on the assessable profits made during a year of assessment that starts from 1 April of that year to 31 March of the subsequent year.

2. Salaries Tax

Personal tax is often referred to as salaries tax — it applies to all locally employed individuals and expatriates. Due to Hong Kong’s territorial principle of taxation, individuals are taxed only on income they have earned in the city. Salaries tax is chargeable to a person’s income from employment, minus allowable deductions, charitable donations and personal allowances.

All income from Hong Kong employment is regarded as sourced in Hong Kong. If an individual is employed by a non-Hong Kong entity, they are only assessed on the income made regarding services rendered in the jurisdiction. Tax will not be charged on services rendered outside of Hong Kong. Also, if a non-resident visits Hong Kong for 60 days or less during a tax year, then they are not liable for salaries tax.

Rates:

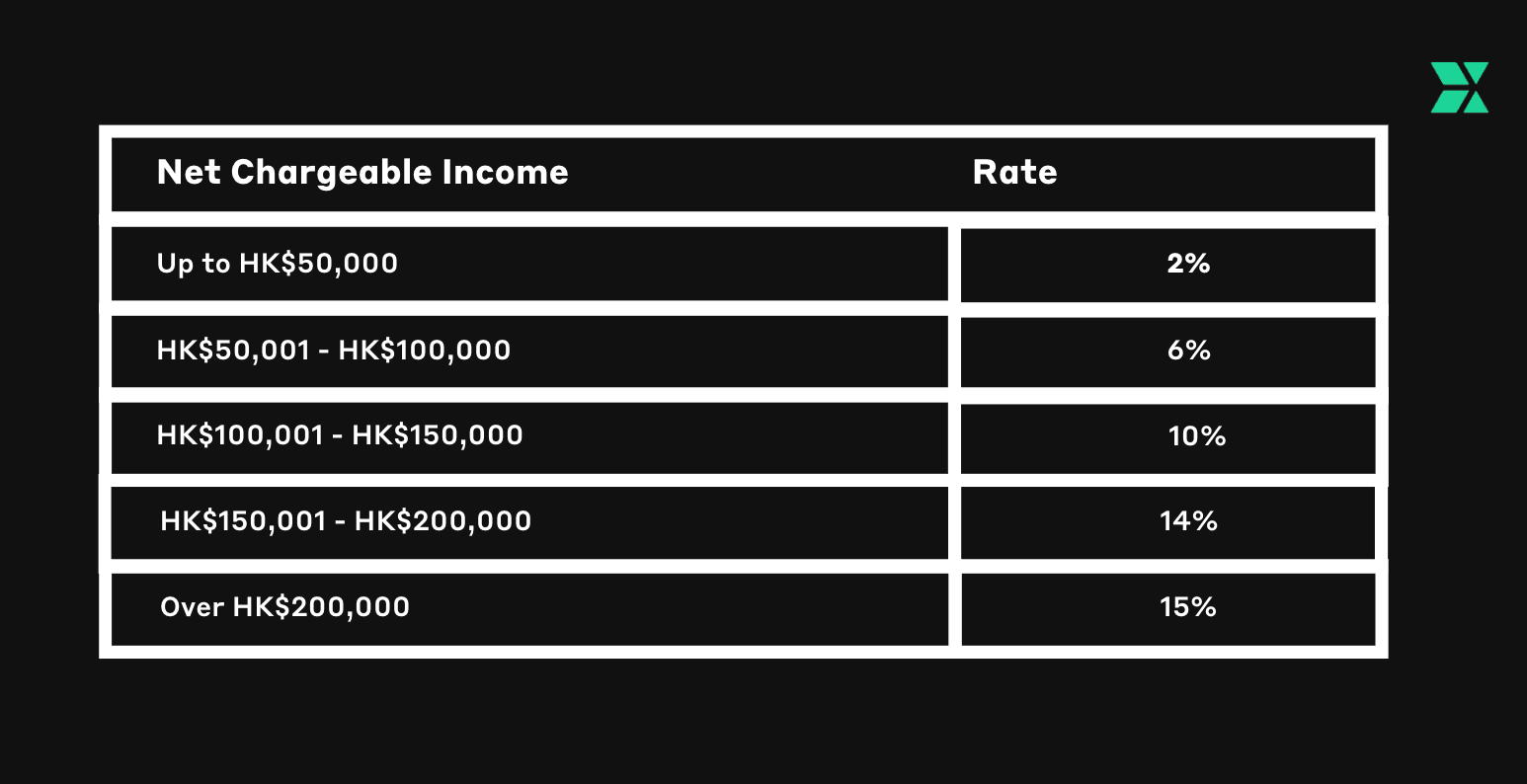

The more an individual earns, the more tax they will be liable to pay. The marginal tax rate ranges from 2-17% with a cap set at 15% on taxable income without the deduction of allowances.

Deductions:

As long as your expenses are exclusively incurred as a result of you being able to earn an income (i.e. related to your work in Hong Kong), then you will be able to lawfully deduct them from your tax return. These types of expenses include:

- Self-education expenses of up to HK$100,000.

- Home loan interest of up to HK$100,000.

- Elderly residential care expenses up to HK$100,000.

- Mandatory contributions to the Mandatory Provident Fund (MPF) or Recognized Occupational Retirement Scheme, up to HKD 18,000.

- Approved Charitable Donations exceeding HK$100 to approved charities, up to a maximum of 35% of assessable income less other deductions.

- Qualifying premiums up to HKD 8,000 for a voluntary health insurance scheme policy.

- Qualifying annuity premiums for MPF voluntary contributions paid, up to a maximum of HKD 60,000.

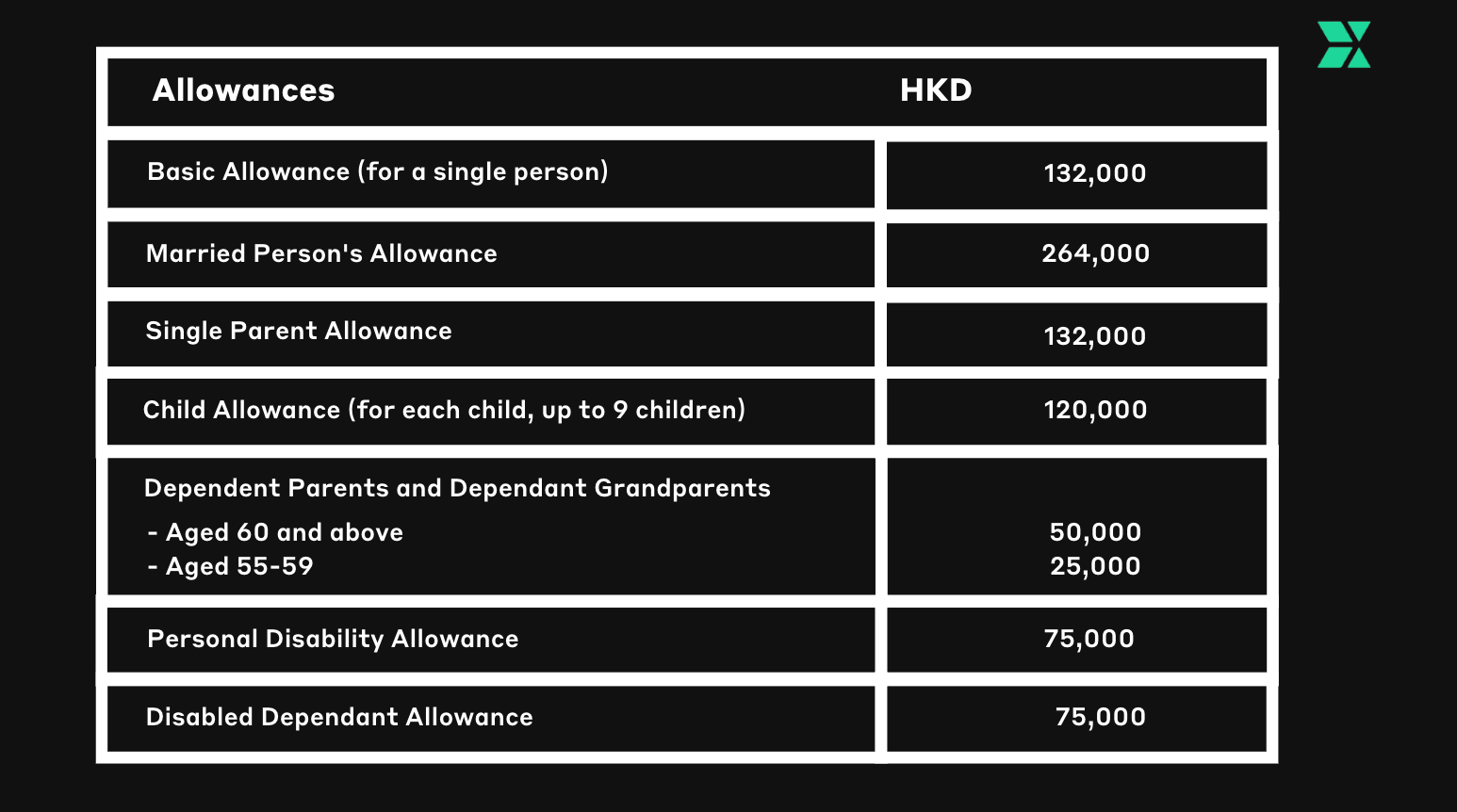

Allowances:

Income that is subject to salaries tax can be reduced by personal allowances before the tax rate is applied. These allowances include:

3. Property Tax

All property owners are taxed on the rental income they earn from their properties that are located in Hong Kong. Government and consular properties are exempt from paying property tax.

Rate: Property tax is charged at a flat rate of 15% on the net assessable value of the property — determined by the rent, service charges and fees paid to the owner. There is a statutory allowance of 20% on the net assessable value for repair and maintenance.

Other Taxes/Levies

Aside from the income taxes mentioned above, there are a number of other government charges, fees, rates, levies and duties that may apply to residents in Hong Kong. These include:

-

Stamp Duty: Stamp duty refers to the tax that needs to be paid to the government when someone buys property in Hong Kong. Considering the high price of rent in the Special Administrative Region, it’s little surprise that stamp duty can come at a hefty cost, too. In fact, it can drastically alter the cost of a property.

There are three main categories of stamp duties related to selling or buying properties in Hong Kong. They include Ad Valorem Stamp Duty (AVD), Special Stamp Duty (SSD) and Buyer’s Stamp Duty (BSD).

Unlike non-residents and property investors, it’s important to note that Hong Kong permanent residents who are buying their first homes are exempt from paying most of the stamp duties — a measure implemented by the government to try to slow down the drastic rise in home prices due to foreign interest.

The maximum AVD on the sale and conveyance on non-residential property is 8.5% of the value of the property. The AVD on residential property is a flat rate of 15%.

-

Betting Duty: From authorised lotteries, horse races and football matches, betting duty is charged on winnings obtained through betting events with the duty ranging from 25% to 74.5%.

-

Customs and Excise Duty: Imports into Hong Kong are generally tax-free except for motor vehicles for use on the road which is subject to a First Registration Tax administered by the Transport Department. Other goods subject to excise duties, whether imported or locally manufactured, include tobacco, liquor, hydrocarbon oil and methyl alcohol. There is no tax or excise duty on exports from Hong Kong.

-

Social Security Contributions: Both employers and employees are required to make mandatory contributions of 5% of the employees’ income to the MPF scheme. The minimum and maximum income levels are HK$7,100 and HK$30,000 respectively for employees who are paid monthly. Employees who earn less than HK$7,100 per month aren’t required to pay the 5% contribution, however, their employers are.

Legal Obligations & Disputes

It’s your legal responsibility to ensure that you declare all of your annual income to the IRD and duly pay your taxes in a timely manner to avoid being penalised with hefty fines or facing criminal prosecution. To avoid the latter, make sure you keep business and accounting records for at least seven years to back up all claims, and file your tax return correctly and in a timely manner, before the submission deadline.

Inform the IRD if you:

- Did not receive your tax return from them within 4 months after the year of assessment.

- Found an error in your submitted documentation.

- No longer have a Hong Kong source of income.

- Leave Hong Kong for a period of time.

- Change your registered address.

If you disagree with the IRD’s assessment, you can contest it within one month of the issued date of notice. You will need to clearly state, and be able to back up, your reasons for the objection.

For more information on filing your personal or corporate Hong Kong tax return, visit www.ird.gov.hk.