Guides

How Amazon Sellers Can Forecast Their Cash Flow

13.10.2021

Being a successful Seller on Amazon is somewhat of a Catch-22 situation: the better you sell, the more products you need to purchase. However, the key issue remains — you don’t have the cash on hand when you need it the most.

Consequently, not having a steady cash flow stream can cause major disruption to your Amazon business in the following ways:

- Inventory purchases can’t be made on time

- Longer stockouts can’t be prevented or catered for

- You can’t make payroll

- You could fail to pay your warehouse lease

Basically, selling on Amazon requires cash and a lot of it.

The Importance of Cash Flow for Amazon Sellers

Compared to other business models, the scalability of the Amazon FBA business model means that the issue of cash flow can arise faster and be more pronounced.

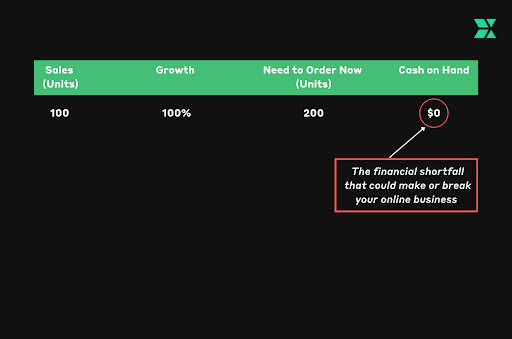

For example, if you are growing at 100% month over month on Amazon (which is very possible), and you have already sold 100 units, this means that you need cash to purchase the next 200 units to support that growth (as per the table below). While tapping into your savings may seem like the obvious choice, if you are implementing the model above successfully then your savings likely won’t be enough to cover the shortfall.

As an Amazon seller, you’re likely aware of the fact that the Amazon A9 algorithm does not take kindly to stockouts. As a result, being out of stock may cause you to lose your keyword ranking and sales during periods of stockouts. Therefore, it’s vital to have cash on hand to ensure you always have stock. Enter the Amazon inventory management that goes hand-in-hand with cash flow.

Cash vs Profit

Even if your Amazon business is hugely profitable, there may be a delay of when your products are sold on the eCommerce giant and the time it takes for payment to reflect into your bank.

But before going further, it’s important that we define exactly what profit is:

- Profit is a financial gain, and the difference between the amount earned and the amount spent in buying, operating, or producing something.

Therefore, profit refers to the process of what is earned, not when you get paid in cash. You can earn a profit in a transaction and not get the cash for this transaction until sometime in the future.

You cannot pay your supplier or logistics company with your profits. So, it is your job as an Amazon business owner to work around this issue and acknowledge that a large profit does not necessarily mean a large liquid cash balance.

How to Avoid a Cash Crunch

A cash crunch refers to the situation where you don’t have the cash on hand when you need it. For example, your supplier needs you to pay the final balance of US$ 30,000 to ship out your order from the factory but you only have US$ 5,000 on-hand, and your Amazon cash balance won’t be settled into your bank account until seven days later. You’re therefore in a cash crunch of US$ 25,000 which will ultimately affect your bottom line.

So how do you avoid this situation? You will need to forecast your cash needs for the next 30 to 60 days. You can do this by tallying:

- Your liquid cash on hand

- Forecasting your cash inflow

- Forecasting your cash outflow

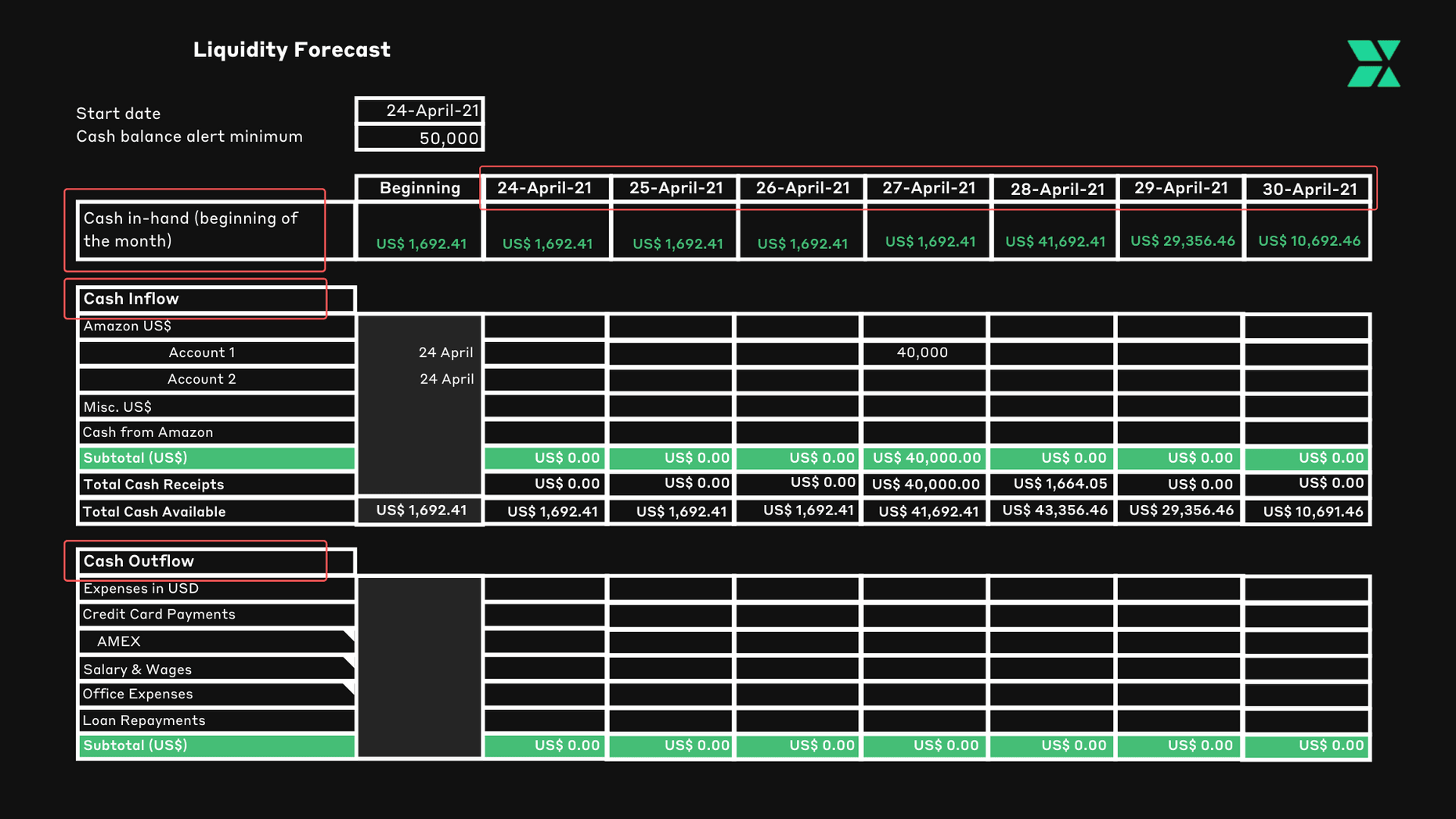

To create this type of reporting, you can use a spreadsheet to plot the forecast dates on the Y-Axis while plotting the Cash in Hand, Forecast Cash Inflow, and Forecast Cash Outflow categories on the X-Axis:

1. Cash in Hand

Firstly, you will need to take into account all the cash that is immediately available to you. It doesn’t have to be cash in your bank account. It can be assets that can be converted into cash quickly, such as stocks, bonds or time deposits. Other cash equivalent assets that you could access immediately, include:

- Cash in current accounts

- Cash in savings accounts

- Paypal balance

2. Forecast Cash Inflow

For Amazon sellers, most of the cash inflow will be from the balance of the sale from your Amazon account. To forecast cash inflow, you will need to estimate the monies that will be deposited in the future. Amazon keeps a balance of your sales for 14 calendar days, so this estimate will need to be panned out over two weeks.

There are multiple ways to estimate cash inflows for your Amazon business, however, some are more complicated than others. To keep things as simple as possible, you can estimate the next Amazon cash inflow by averaging the last two settlements and multiplying that by a growth rate. Here’s an example: If today is 1 May 2021, then you can derive the next Amazon payment (May 14, 2021) from the following:

- Sales growth is 10% month over month

- Most recent Amazon deposit (April 28, 2021) US$9,500

- Amazon deposit (April 14, 2021) US$8,300

Based on the above, the estimated cash inflow from Amazon based on the information above will be:

- May 14, 2021 payment = US$9,790 [(US$9,500+US$8,300)/2] + (10% * [(US$9,500+US$8,300)/2])

The Amazon payment will, therefore, equate to US$9,790. This amount plus your current cash in hand balance is what you have to fund your operations (wage, supplier, shipping etc).

3. Forecast Cash Outflow

Cash outflow refers to any payment to suppliers or any existing financial obligation. For Amazon sellers, the most common uses of cash outflow are:

- Payment to suppliers

- Wage

- Payment for shipping and warehousing

- Credit card payments

- Loan payments

- Marketing agency

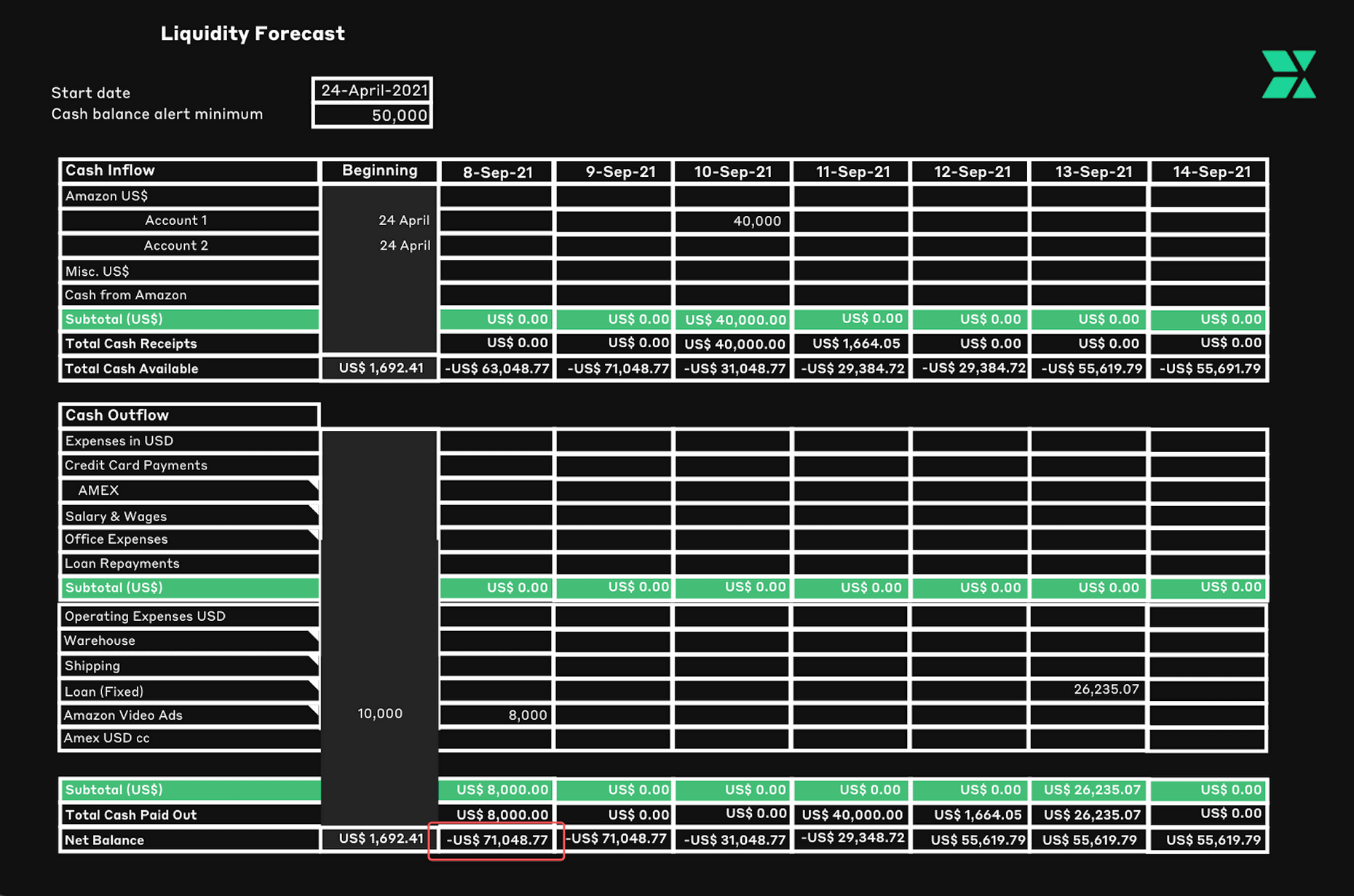

You can easily plot these outflow obligations on their due date in the spreadsheet and net this against your current cash balance forecast into the future. If any future date indicates a negative net balance, then you will have a cash shortfall.

So, if you have to pay your supplier US$7,000 on 5 May, nine days before you get your next estimated Amazon payment of US$9,790. You would either 1) have to wait until 14 May, but this may result in stockouts, or 2) receive finance for your cash shortfall.

Options to Finance your Cash Shortfall

There are a few ways to plug your cash shortfall which include:

- Dipping into your savings

- Receiving a personal line of credit

- External Debt

When your Amazon business keeps growing, your personal financial resources - such as your savings or your line of credit - may not be enough to satisfy your cash shortfall. In this instance, you may need to get external debt. A cashflow forecast can predict these types of circumstances, knowing when you’ll need to resort to debt to get ahead.

Why Debt Can be a Good Thing

The word debt usually comes with negative connotations. However, going into debt is only a bad thing if you’re spending the loaned money mindlessly on things like a shopping spree or getting a nicer car. Conversely, when used productively, debt can be leveraged to increase your income and profit margin. There’s a reason they say, “You need money to make money” — and debt can help do just that.

For an Amazon Seller, debt can be used in two ways:

-

To make sure your operations will not be disrupted, which means you have the cash to pay for inventory to prevent stock out or wages to keep your business running.

-

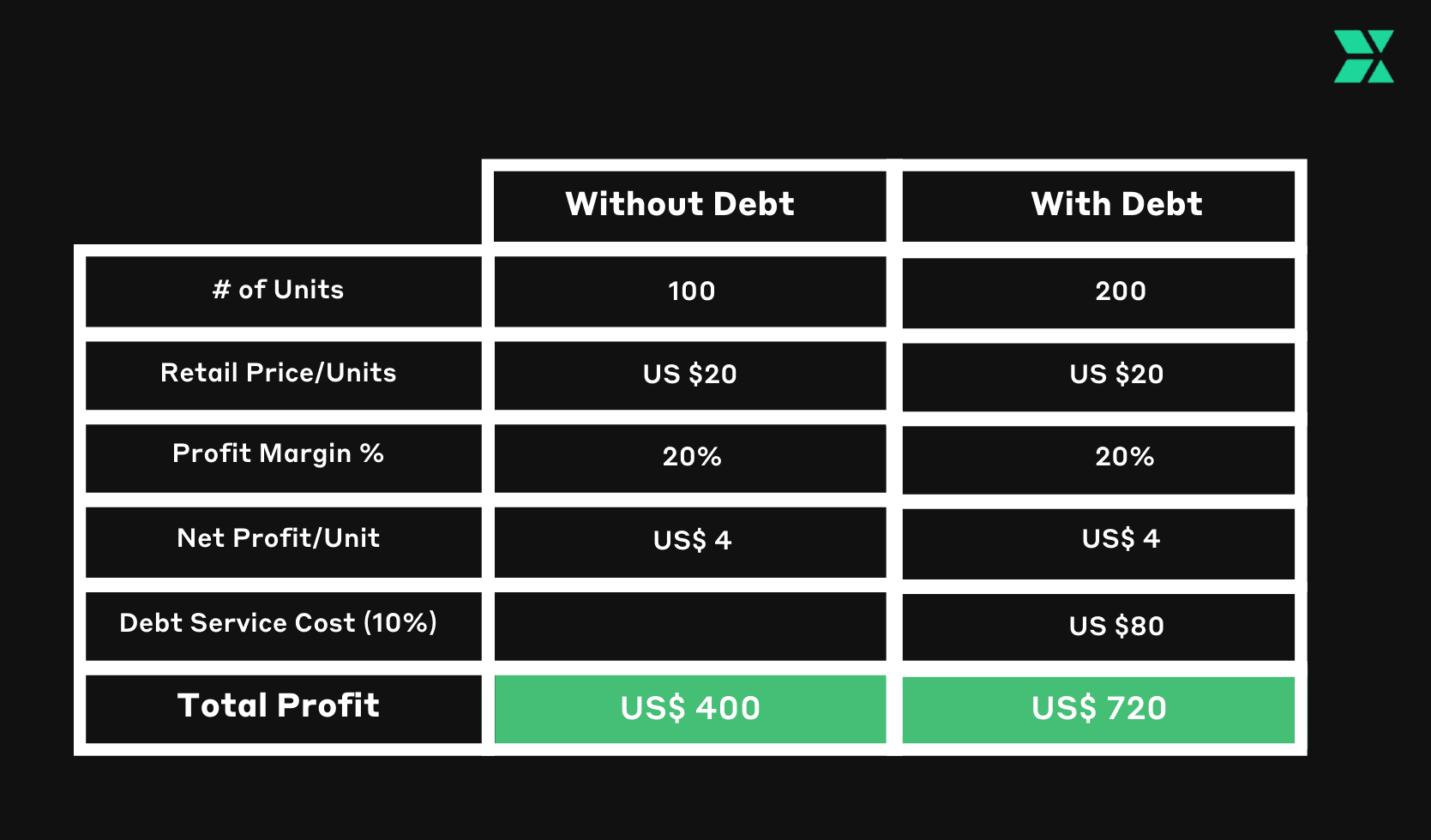

To increase your profit and earnings. For example, you only have enough cash to purchase 100 pieces of your product which are being sold for US$20, and where your net profit margin for each unit sold is 20%. So, your total net profit in this scenario would be $400. However, there is actually demand for 200 pieces of your product. So, if you use the debt to purchase the additional 100 pieces, and service the debt cost, your net profit will be well over $400.

By using debt to purchase more inventory, you can increase your profit by US$320 than if you didn’t take up the debt to fund the purchase of the additional 100 pieces of product.

With 80% of small business owners being rejected for bank loans, many Amazon Sellers are looking at alternate forms of financing for their online stores. You can find out which one may be best for you, here.

In conclusion, Amazon Sellers should always be estimating their cash flow needs to support the growth of their Amazon business. To avoid a cash crunch, do not be afraid to use debt and start reaching out for financing at a crucial moment when you need it.

*Currenxie is a proud participant in Amazon’s Payment Service Provider (PSP) Program.