Guides

How to set up a business in Japan

1.08.2022

The Japanese yen has recently rebounded from historic lows against the US dollar. While economists and experts have raised concerns about the consequences if it continues to fall, there is a silver lining for businesses and importers. With the world slowly returning to post-pandemic normality, the weakened yen could be a welcome pretext for entering the Japanese market or importing goods from the region.

Here, we’ll explore the relationship between exchange rates and imports, the pros and cons of doing business in Japan, key steps for incorporating your company and the importance of picking a suitable payment platform to handle multicurrency payments.

Note: this article does not constitute business advice. Please seek a certified consultant and exercise judgement for professional guidance or services on business expansion.

Exchange rates and imports explained

The exchange rates between two currencies can influence the price of goods traded between economies and determine a product’s competitiveness. Generally, the weaker the domestic currency is against a foreign currency, the more competitive its exports are. In contrast, a strong domestic currency would render exports uncompetitive.

For example, if the exchange rate is JPY 100 to 1 USD, a USD 20 product would theoretically cost a Japanese consumer JPY 2,000. If the dollar strengthens against the yen by 10%, the price of the same product will become JPY 2,200 while remaining unchanged for the US consumer. While goods from the US become less competitive in Japan, goods leaving Japan overall will become more competitive in the US as the lower exchange rate constitutes a lower price.

Japan has traditionally relied on a weak yen to fuel its export-oriented growth. The currency has seen a series of downward spirals and violent swings in the past decades with sporadic upticks. As a result, Japanese manufacturers rely on a weakened yen and Japan’s stable economy to stay competitive, while companies abroad benefit from importing goods from the country and setting business terms in yen when the currency drops in value.

Pros and cons of doing business in Japan

With the yen at historic lows, entering the Japanese market or starting to export from the region may be a logical move. Here are a few reasons why.

Market size

Japan is the world’s third-largest economy. With one of the world’s highest per capita incomes, an astonishing GDP of USD 5 trillion and an industrious culture renowned for quality and efficiency, the nation has endless potential for businesses.

eCommerce giant

Japan now boasts the fourth-largest eCommerce market, behind China, the UK, and the US. The pandemic has accelerated the consumers’ move toward online purchasing, which could result in the Japanese eCommerce market value soaring to USD 143 billion by 2025.

Market efficiency

Japan is long-known for its state-of-the-art business infrastructure and development. Meanwhile, its government has recently introduced various measures to attract foreign investment, giving entrepreneurs an edge by waiving various requirements.

Huge international demand

Japanese products are highly sought after globally. The international popularity of Japanese culture is spilling over to related export products. For example, the value of Japan’s food exports increased by 25.6% from the previous year, reaching USD 9.67 billion in 2021 and was driven mainly by beef, sake and whisky.

There are also several caveats to consider, however:

Market unfamiliarity

As with entering any new market, doing business in Japan can be drastically different to doing business in your home country. Apart from regulatory differences, there are also different customs and cultural norms one needs to be aware of.

For example, the notion of getting a signature stamp, the importance of business cards and punctuality, and the preference for subtlety may be overwhelming for some.

Complex tax regime

Japan’s corporate tax rate is calculated in tiers depending on your overall income, and there are also different taxes imposed at national and provincial levels. When added together, the total tax rate for businesses could be higher than the 21% flat rate that the US charges.

Fluctuating spending power

Economists have warned that a prolonged weak yen could push up fuel and raw materials costs. In this instance, the Japanese consumer would be worse affected as imports and goods would become more expensive.

Setting up a business in Japan

If you’ve decided to set up a business in Japan, you first need to get the right kind of visa. Japan has two common visas catering to foreign entrepreneurs: the Business Manager Visa and the Startup Visa.

Business Manager Visa

To apply for the Business Manager Visa, you need to prove you’re in the process of starting a company in Japan, sign a lease for an office, hire more than two full-time employees and invest at least JPY 5 million (roughly USD 37,000 as of early July 2022).

After you file the paperwork and get your application approved, you’ll get “Business Manager” status, meaning you’re eligible to conduct business in the country. While you only have a six-month window to kick off your business after entering Japan, you can always apply for an extension thereafter.

See more: applying for a Business Manager Visa

Startup Visa

The Japanese government has introduced the Startup Visa programme in ten key municipalities, including Tokyo, Hiroshima, Fukuoka and Kyoto. While most municipalities have a specifically-targeted sector they want to focus on, others like Tokyo and Hiroshima have none in particular.

To apply, you need to submit your business plan to a specific municipality, known as a New Business Implementation Plan (NBIP). Once your NBIP is approved, you can enter your municipality of choice with a Business Manager status without having to fulfil the investment requirement.

See more:

- Applying for a Startup Visa in Tokyo

- Applying for a Startup Visa in Fukuoka

- Applying for a Startup Visa in Kyoto

Business life post-visa

Once you have a valid visa to do business in Japan, there are still a few hurdles you need to face.

First, you need a business address to be eligible for incorporation. Renting an office for the short term is very popular these days. With that, you can enjoy a range of benefits like flexible lease terms, low startup costs, access to amenities and better access to city centres. Coworking spaces are also a common option for startups and entrepreneurs.

For those opting for a long-term commitment, renting long-term can be more convenient and having a permanent business address also helps convey a sense of trustworthiness and legitimacy.

With an address settled, you can then incorporate your business. If you’re setting up a new business as a foreign individual, you need to register a company seal and a seal certificate at the local city hall. Then, you need to present each investor’s local bank account and a statement to verify the capital deposit.

If you’re starting your business as a subsidiary, you also need to present your parent company’s registry certificate and notarised signature, seal certification for each director and the representation director’s bank account together with the bank statement.

How about exporting?

Japan is a major exporter worldwide and maintains a strong trading relationship with the US, China, the UK and the EU. While automobile and tech gadgets are the cornerstones of the country’s export industry, consumer products like food, spirits and textile are hugely popular.

There are ample opportunities for merchants wishing to export high-quality Japanese products to their home market. In 2020, the US imported USD 84 million worth of distilled spirits, USD 82 million worth of tea and USD 77 million worth of other foodstuffs. And as of 2021, Japan exported a total of USD 320 million of foodstuff, beverage and tobacco products to the EU. Items like craft gin have made a global foothold while whisky export in value has soared from USD 20 million in 2012 to USD 360 million in 2021.

Japan’s artisan products are also gaining popularity in recent years. World-class museums like Tate in the UK and Brooklyn Museum in the US are selling Japanese items for their superior design and attention to detail. Japanese textiles are also very much sought after worldwide, with the country exporting USD 7.2 billion worth of garments in 2020.

If you want to export Japanese goods, you can submit your declaration to the customs and the nature of goods, such as category, quantity and price. You would also need to present your goods to customs for physical inspection and provide relevant invoices and other documents if needed.

What is Japan’s eCommerce market like?

Besides boasting a robust import-export market, Japan ranks as the world’s fourth in eCommerce market size with a sales volume of USD 128 billion in 2021. It is also a global leader in mCommerce thanks to its high internet penetration and ultra-advanced infrastructure.

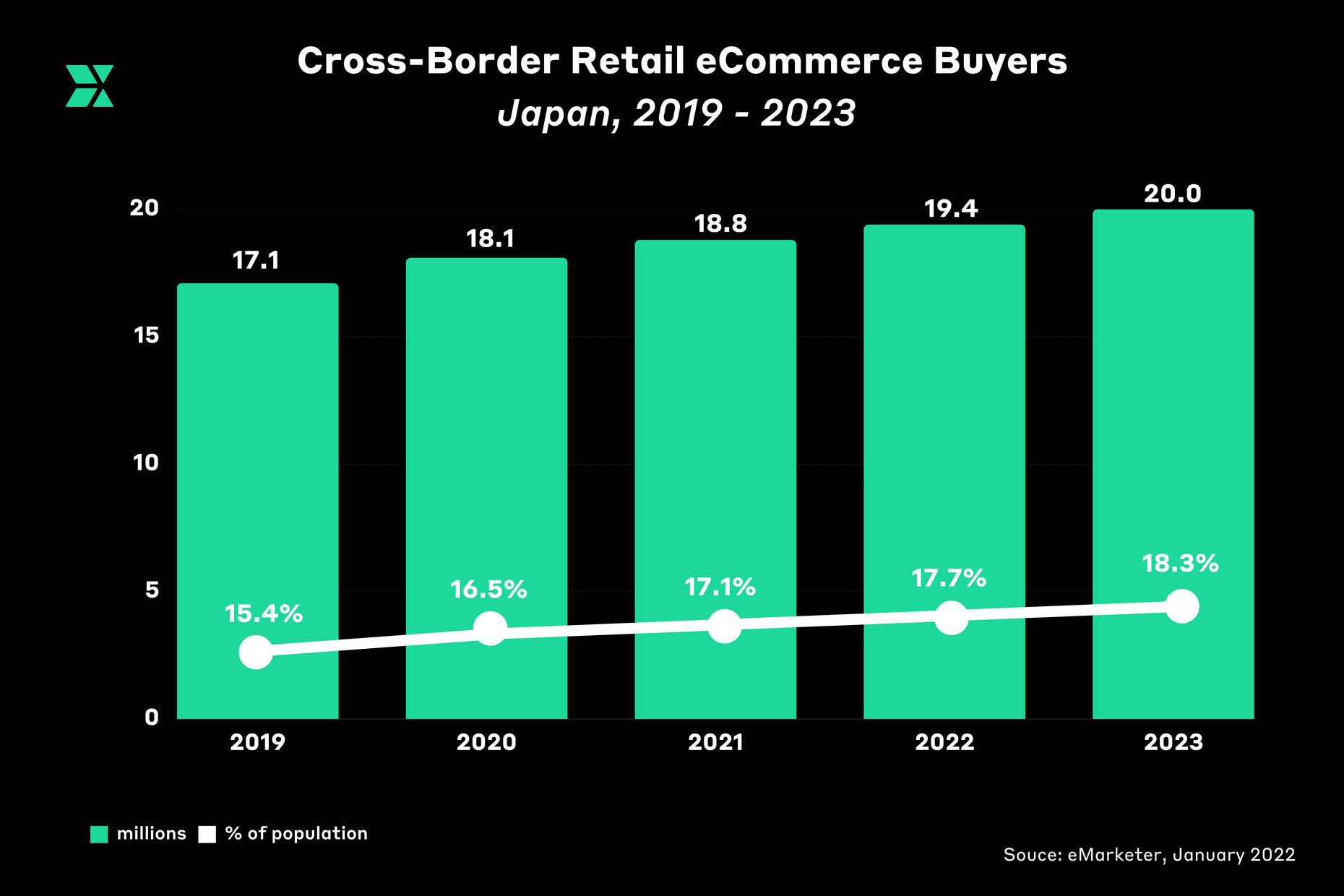

Japan’s three largest online retailers, Rakuten, Yahoo and Amazon, are leading the market’s growth and providing a wide range of products. Meanwhile, consumers are growing accustomed to overseas products, with cross-border retail eCommerce expected to penetrate 18.3% of the population by 2023. This phenomenon is welcoming for foreign entrants hoping to enter this market traditionally more receptive towards local products.

If you’re planning to be an eCommerce seller, having the right logistics partner is key to providing the high-quality delivery services Japanese consumers expect. You can rely on large platforms like Amazon to export your inventory. Amazon’s Fulfilment by Amazon (FBA) services can help you sort out the logistical and warehouse issues if you can meet their shipping requirements.

Besides Amazon, the local champion Rakuten also offers exceptional logistics and fulfilment services, which perks like one-day shipping are matching consumers’ tastes for quick and reliable deliveries. Alternatively, you can seek other logistics services to ship and store your goods and then sell your products on your eCommerce page.

The importance of localisation

Given the different market landscapes and cultural barriers, adapting to the local market landscape is key to a successful entry.

Knowing about Japan’s unique online shopping events is a great way to drive sales throughout the year. Though well-known peak seasons like Black Friday and Christmas are also present, leveraging cultural-specific celebrations like the Shichi-Go-San and White Day or sales events like the Hatsu-Uri on 1 January or the Ochugen in summer can not only boost sales but also demonstrate your relevance in the market.

Further, Japanese eCommerce sellers are expected to deliver exceptional customer service, just as their brick-and-mortar counterparts. Minor issues like slow loading speed or unlocalised site content could cost dearly. So it’s important to polish your online touchpoints and provide quality after-sales service and customer support.

Also, when promoting your product, it takes a lot more than translating your content to Japanese. Rather, be thoughtful and creative when localising your content, so it resonates with the audience while conveying your brand personality. Content that is inaccurate or unable to build rapport will surely usher your potential customers elsewhere.

Refer to our eCommerce eBook for the latest insights and best practices.

Opening a bank account in Japan

Having a bank account is fundamental when it comes to doing business in Japan. Even though the process may be bewildering, a local bank account can bolster your credibility – it’s also a prerequisite for the Business Manager visa scheme.

Before applying for a business bank account, you’ll first need to have a local personal bank account. To open one, you’ll need your Japanese residence card, passport, local address and phone number, the relevant visa and a personal stamp (known as a Hanko) which you can obtain in any kiosk situated around the country.

Opening a personal bank account should take roughly one to several days, but a corporate bank account could take up to a month due to its complexity. You would also need the following documents on-hand for a corporate account:

- A copy of the certificate of corporate register

- Certification of official registration of the corporate signature

- Corporate bank seal certified within the last three months

- Your certificate of incorporation

- A corporate signature stamp registered with the regional Legal Affairs Bureau

- A corporate signature stamp that you’d use for bank transactions

- The resident card of the representative director

While you may need local bank accounts to fulfil local operating requirements, traditional banks usually charge high fees for international transfers and cross-border payments – and may take days to process. Additionally, banks may mark up their interbank foreign exchange rate in addition to charging commission fees, meaning you may be exposed to extra costs. This may pose a problem as import-export and eCommerce companies need fast and cost-effective cross-border transactions and foreign exchange solutions.

It’s true that payment platforms like PayPal can help you receive payments from customers worldwide. But if you want your business to thrive and truly go global, you need a payment platform that can handle cross-border transactions and currency exchange quickly and at a fraction of the usual cost.

By offering a digital solution to an international problem in the form of its Global Account, Currenxie is opening up global commerce to all players. Our Global Account helps businesses of all sizes manage their own digital bank account details in every market they operate in. We also offer quick and cost-effective solutions for cross-border transactions, and we offer mid-market rates for all foreign exchange with no hidden costs.

Also, our global banking network is the biggest in the world, on which you can rely to manage transactions in and out of Japan with real bank account numbers. You can count on us to send and receive money across currencies fast and comply with financial regulations while integrating with your bank accounts and eCommerce platforms.

Sign up for your Currenxie Global Account and let us help you realise your business ambitions in Japan today!