Articles

Digital is Transforming Payments — Here’s How it Affects You

26.01.2021

It took COVID-19 just a few months to transform the world. And while the globe breathes a sigh of relief as a potential vaccine promises to bring some semblance of normality back into our lives, we’re still grappling with what the pandemic’s impact will ultimately be. However, if one thing is certain it’s that COVID-19 accelerated a digital transformation shift that was expected to take years.

While many countries are currently in various stages of recovery, organisations across the globe have been forced to reset their strategies and pivot their business models whilst transforming their operations to match the new digital expectations that have emerged as a result of the pandemic.

Stringent lockdown measures have forced consumers to use digital channels to communicate with the outside world and purchase goods. This change in behaviour has caused them to develop much higher digital expectations, resulting in businesses of all sizes accelerating their digital adoption.

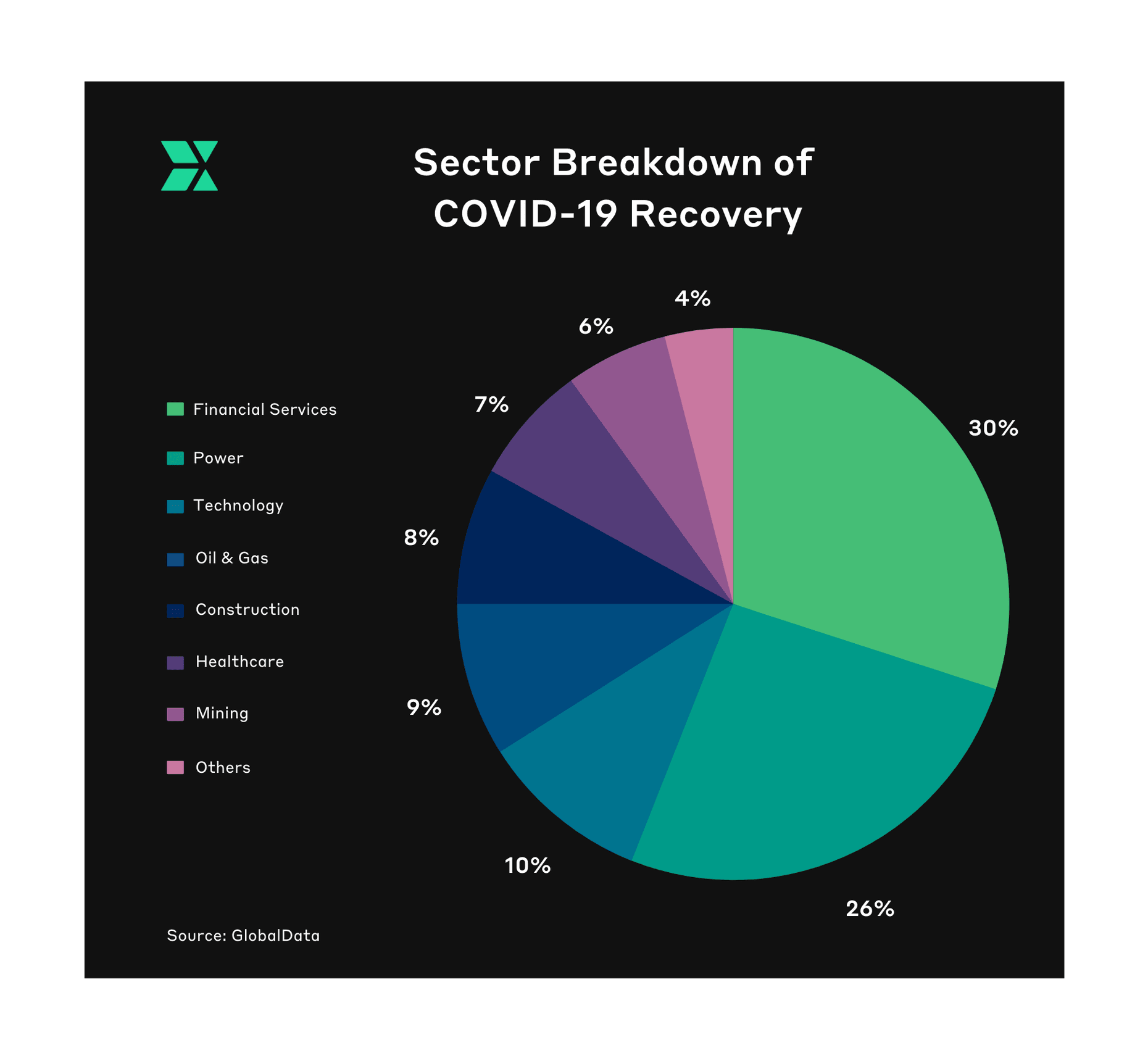

A new report reveals that organisations across all sectors are investing in new technology as a direct result of the impact of COVID-19. From food and education to fitness and pharmaceuticals, certain industries have seen their number of users soar, with consumers likely to continue to use these digital offerings well after the crisis. However, according to GlobalData, it’s the financial services (FS) sector that will lead the way in recovering from the pandemic thanks to digital disruption.

The Acceleration of Digitisation

Digital transformation in the finance industry is about more than just technology. Positively impacting business, it comes with the assurance of faster, cost-effective operations that can help speed up regulatory requirements, offer improved customer experience and help financial institutions (FIs) remain competitive.

FIs who had already invested in digital before the crisis hit have been better prepared to navigate and respond to it. Conversely, those who had yet to kick-start their digital transformation journeys have been forced to do so in a bid to ensure their survival.

Removing the roadblocks that historically came with digital transformation by exposing an organisations’ true capacity for innovation, COVID-19 has shattered the timelines previously thought necessary for designing, building and launching new digital products.

With digital payment solutions playing a crucial role in digital transformation in the finance industry, fintech — an industry that has almost doubled its value this year to US$1 trillion — is changing the world of payments as we know it. Here’s how:

-

Online Payments

While cash is still dominating commerce, with 69% of global consumers making transactions in banknotes and coins, the rate of its circulation has fallen — suggesting that consumers are hoarding their bills rather than spending them. Conversely, the number of card payments being issued is soaring, partially due to the eCommerce boom which itself is a trend that has leapt forward by several years.

-

Mobile Payments

While the increase seen in mobile payments is nothing new, it has undoubtedly benefited those who have been forced to digitise their finances because of the pandemic, and who don’t have access to a computer. In fact, a recent survey found that 15% of consumers are now mobile dependent when it comes to their financial needs.

-

Contactless Payments

Because they pose less of a risk of contracting COVID-19 when buying products in a brick-and-mortar store or online, contactless mobile payments in 2020 have already surpassed those made in 2019, clocking a 34% growth. Contactless mobile payments are also becoming an increasingly more convenient way to pay rather than carrying cash or a credit card.

-

Cards

COVID-19 has likely changed payment behaviour faster than any single technology ever has. While physical shops have mainly reopened in most parts of the globe, thanks to the boom in online shopping, consumers are primarily sticking to plastic — some who only recently adopted digital methods of payment. Visa, for example, saw more than 13 million customers in Latin America make their first-ever online transaction in the first quarter of this year.

-

P2P Transfer Services

There’s been a massive spike in the number of consumers who are using Peer-to-Peer (P2P) payment apps to send money to relatives or give donations to movements like Black Lives Matter. With a new user growth of 19% since the start of the pandemic and a monthly increase of 9% per month, more people are starting to take advantage of P2P payment methods as they’re convenient and super simple to execute.

-

Digital Wallets

Thanks to the sustained need for public hygiene at checkout, digital and mobile wallets are becoming commonplace, with Apple Pay and Google Pay becoming the main beneficiaries of this behavioural change. According to a recent survey, 50% of American shoppers are uncomfortable about entering their financial details in order to make an online payment, whereas 44% of them said they felt “more secure” using Apple Pay or Google Pay as an alternative.

-

eBrokers

The COVID-19 pandemic has forced consumers to shift their mindsets from one of wants vs needs. As a result, many are focusing on saving and investing over splurging. Recent data reveals that millions of households who received stimulus cheques and furlough payments are hiring eBrokers to bet on stocks. In fact, according to a recent report, there has been a 40% surge in business for digital discount brokers as consumers shift to trading as a means of saving.

-

Digital Business Accounts

Digitisation is also racing ahead in other areas of finance, particular platforms offering an alternative to traditional banking. Whether it’s opening a business account, getting access to foreign exchange or making cross-border remittances, incumbent banks have failed to keep up with consumers’ evolving needs in the ‘new normal’. With modern interfaces, online applications and 24/7 access, digital business accounts offer a seamless solution over the opening and maintaining traditional commercial bank accounts. Find out more here.

Evolving With Digitisation in an Ever-Changing World

In response to COVID-19, FIs have shown speed and agility in re-imaging their business models and re-inventing the ways they can meet rapidly-shifting customer and marketplace needs — a move that other organisations should try to replicate if they want to thrive (not just survive) post-pandemic.

With consumer expectations shifting, COVID-19 acting as a digital accelerant, and industries evolving at a rapid rate, now is the time for companies to embrace digital disruption and new innovative technologies whilst considering the role they will play, and how they will create value in emerging ecosystems.

While the pandemic will eventually subside, the impact it will leave on the digital world will be a long-lasting one – and it’s up to us to ensure we keep up.