Guides

Everything you need to know about PayPal for your business

7.07.2022

As one of the world’s largest payment platforms, PayPal has helped millions of retailers and consumers worldwide with cross-border payments. Its compatibility with various payment options and devices makes the platform highly popular in today’s highly-diverse online business world.

In this guide, we explain PayPal’s pros, cons and how integrating it with your Currenxie Global Account can help you better manage your cross-border payments and currency conversions.

What is PayPal and how does it work?

PayPal is an online payment platform that lets individuals and retailers open accounts and make transactions securely. Consumers with a PayPal account linked with a bank account, debit card, or credit card can make eCommerce purchases at checkout. Also, PayPal’s compatibility with mobile payments makes it particularly relevant in today’s retail world as mCommerce is gradually becoming a primary sales channel.

When a user makes a transaction, they first link a bank account or a credit/debit card to their PayPal account. Then, they can use their linked payment method to make payments everywhere PayPal is accepted. Meanwhile, the time needed for a transaction varies. While most transactions usually take minutes to process, some fee structures and payment methods may take up to 2 business days.

After the transaction, the money will then sit in the merchant’s PayPal account. The merchant can then decide whether to transfer the funds to a bank account or let them sit in the account. Meanwhile, Paypal offers one of the best security standards in the industry.

Why is PayPal important to eCommerce?

Being one of the world’s largest payment platforms, PayPal can be a great addition to any eCommerce business. In fact, retailers may find PayPal’s competitively-rated add-on services like shipping and invoicing particularly welcoming.

Here are five reasons why PayPal is important to eCommerce:

-

Customer convenience

PayPal lets customers buy directly from your site. Since customers no longer need to jump between sites during a payment journey, they can now enjoy a more consistent purchase experience.

-

Robust security

PayPal’s robust cybersecurity capabilities, such fraud protection, data security and comprehensive customer services make it a trusted favourite for eCommerce businesses and consumers.

-

Checkout compatibility

Whether the customer prefers the debit card, credit card, or bank transfer, you can count on the platform to fully integrate with your system and handle the payments without fuss.

-

Customisation-friendly

Since PayPal can fully integrate with your eCommerce website, you can insert different add-ons and tweak them to your liking. For example, you can add a payment button to your page and customise it simply by copying and pasting prebuilt codes.

-

Mobile friendly

With mCommerce becoming more important than ever before, PayPal’s mobile payment capabilities makes it a great tool for mobile shoppers, which users can pay and receive money anytime via the PayPal Mobile App.

How to set up your PayPal account

Setting up your PayPal account for business is pretty straightforward. Here’s how:

- Go to the PayPal website and click “Sign up”

- Choose to open a business account and click “Continue”

- Insert your name, email address, and password. Then, click “Continue”

- Fill in the form and be sure to include the following information:

-

- Name and address of the business owner

- Account owner’s business email address

- Name and address of the business

- Customer service contact information

- Name of the bank

- Bank routing number and account number

- Add a credit card, debit card, or bank account to your PayPal account

- Verify your email address

With a PayPal business account, you can give access to up to 200 employees with unique login credentials, obtain a customer service email address, and access various additional features.

What are PayPal’s fees?

PayPal’s scale and convenience make it a popular choice for multicurrency transactions. Yet, the price structure for business account holders can be quite different to what personal account users may encounter.

The standard charge for receiving domestic transactions as a merchant varies between locations. For example, domestic transactions in Hong Kong may incur a markup between 1.7% and 3.9% for each transaction plus a fixed fee depending on the currency received. Likewise, merchants in Singapore pay a 3.9% markup plus an additional fixed fee of SGD 0.5 for domestic transactions.

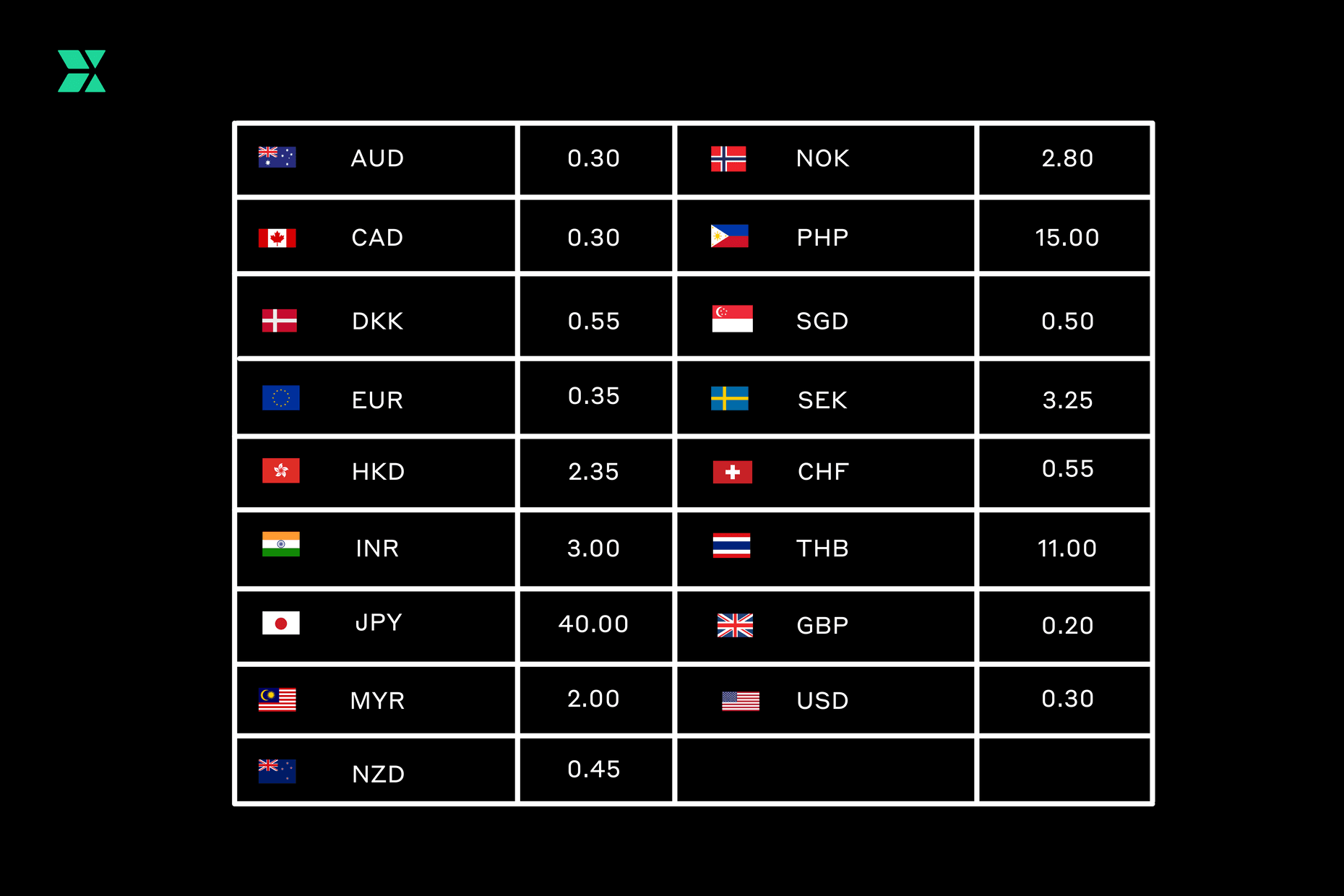

On top of that, PayPal charges an additional 4.4% fee for most international transactions plus a currency-based fixed fee that varies between countries, which we’ve listed below for some currencies that Currenxie supports (as of July 2022):

Exchange rate caveats

Besides transaction fees, making multicurrency transfers on PayPal as a merchant means that the exchange rate may also be an issue. The platform adds a conversion spread of 4% on top of the wholesale exchange rate as it takes the exchange rate from a third party and then adds on the conversion spread.

The price difference between PayPal’s rate and the mid-market rate, the one you see on Google, is evident by comparison. Though exchange rates always differ, the mid-market rate is the real exchange rate that doesn’t include any additional margins. The difference between the two rates is what PayPal earns for each currency exchange.

To make your eCommerce business more open and competitive in different markets, you need a platform that can handle payments and exchange rates globally. A reliable platform should give you the flexibility to grasp new opportunities and handle transactions in different currencies while keeping costs at a minimum.

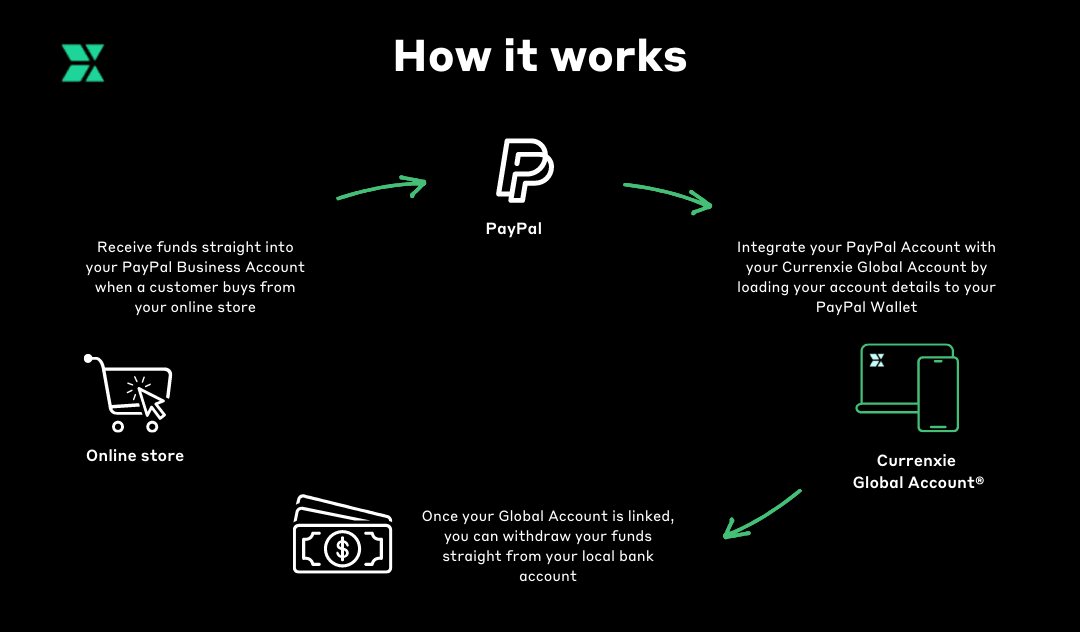

That’s why integrating Currenxie with your business PayPal account can put your eCommerce business in a better position. At Currenxie, we support rapid or real-time transfers for over 18 currencies. We also have the world’s biggest global business banking network that lets you manage cross-border transactions with multiple currencies with real bank account numbers. All our foreign exchange conversions are done at the mid-market rate, with no spread or hidden fees.

Withdraw funds in 18 different currencies and conduct foreign exchange conversions by integrating your PayPal account to your Currenxie Global Account. You can count on us to be flexible and avoid unnecessary fees when growing your online business worldwide.

Sign up for your Currenxie Global Account and automatically receive payments from PayPal.