Press Releases

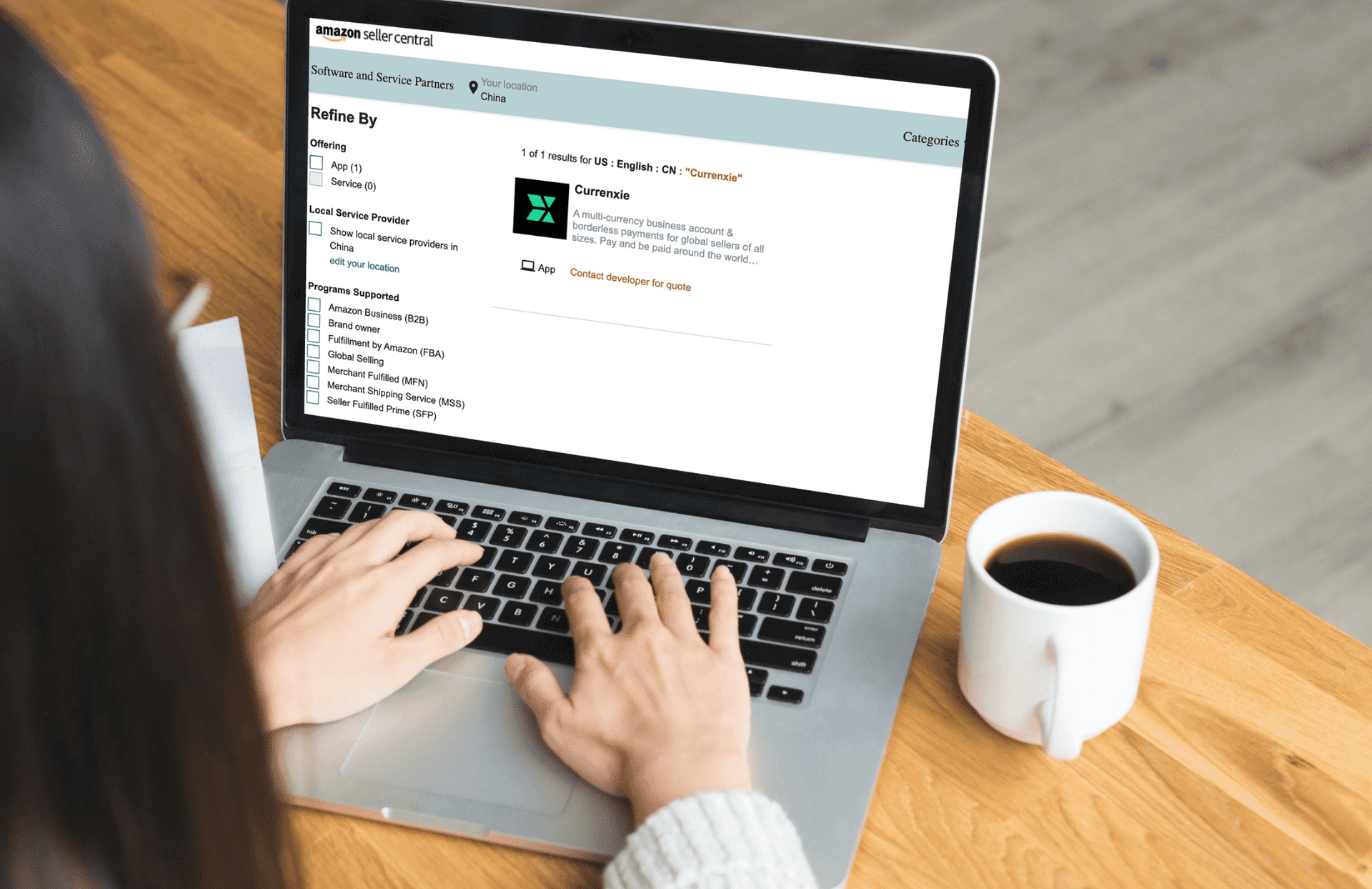

Currenxie’s eMoney License Paves the Way for Expanded Operations in the UK

22.09.2020

A recent report revealed that banks are charging UK SMEs US$6 billion per year in hidden fees for cross-border payments. As the SME sector continues to grow — particularly the eCommerce market — there is an increased need for financial services designed to overcome the challenges of cross-border payments for businesses.

To meet this need, eMoney Institutions (EMI) and Payment Services Providers (PSP) are emerging in the UK as an alternative to the traditional banking industry by offering small businesses convenient alternatives and competitive pricing.

However, it’s not easy to obtain the necessary licenses needed to operate these services. That’s why we’re proud to announce that Currenxie has recently been granted an EMI license by the FCA, signifying trust and reaffirming our commitment to the UK market, and marking a major milestone that will help drive future services in the region.

All firms that provide payment services, eMoney, lending and investment services in the UK need to be regulated by the Financial Conduct Authority (FCA). The organisation is currently the conduct regulator for 59,000 financial services firms and financial markets in the UK, as well as the prudential regulator for over 19,000 of those firms. As of February 2020, only 177 EMI licenses have been issued in the UK (which account for 47.58% of all European EMIs).

“We are very grateful to the FCA for their guidance and assistance in granting us the new license,” says Riccardo Capelvenere, CEO of Currenxie. “We are committed to developing our bank account and payments services for our UK and European clients. The eMoney license will help us deliver future products in our roadmap, and aid us in seamlessly scaling our local operations and services support.”

Currenxie was already a registered Small Payments Institute in the UK, helping UK-based and foreign businesses with borderless GBP payments and foreign exchange. However, with our EMI license, we intend to build out our capabilities in the UK to the level of our flagship multi-currency business account services in Hong Kong.