Press Releases

The Currenxie Visa Business Card Has Arrived!

1.11.2021

Our most requested and anticipated new product has launched!

Despite the fact that there are currently 2.8 billion credit cards in use worldwide, a vast majority of SMEs, startups and entrepreneurs still battle to obtain them for their business.

And if they do manage to land a card for their business, they’re usually hit with restrictions in the form of low spending limits, a lack of transaction data, hidden monthly fees and problematic security issues relating to fraud.

That’s why Currenxie is proud to announce the launch of our Visa Business Card for easier, more secure global payments!

Safety First

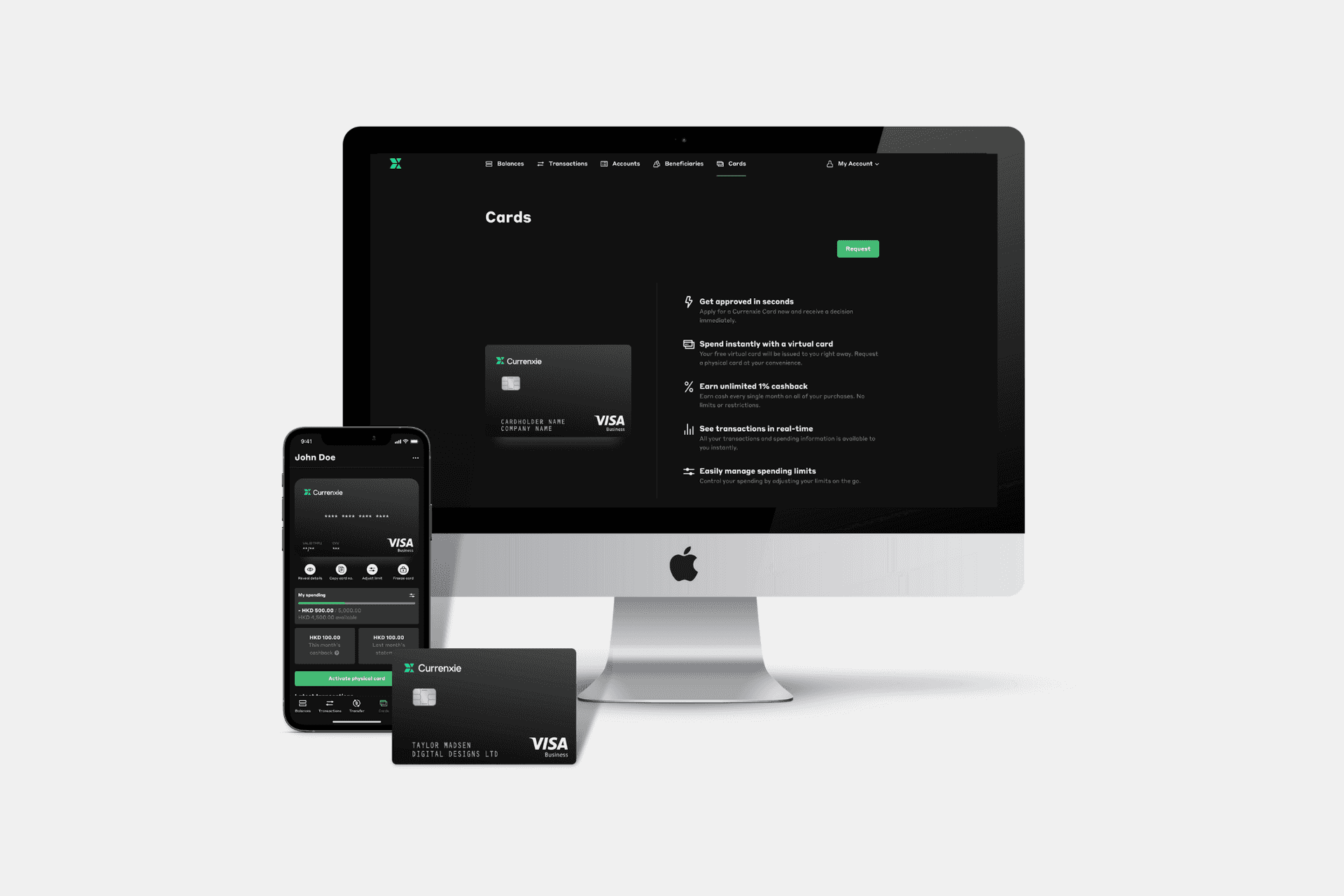

The Currenxie Card has been developed with safety in mind. As a virtual-first card, all of your sensitive information - including your card number, expiry date and CVV - is securely stored in the Currenxie app, where only you can access it.

We went further. The physical companion cards have no visible number, meaning you’re safe from having your card information stolen. Plus, they require chip & PIN for payments, so you can truly have peace of mind that your corporate card - and those of your employees - are protected against fraud.

If that sounds interesting, you’ll be happy to know that a virtual Currenxie Card can be yours almost instantly, for free. With just a few taps in your Global Account, your new card will be issued and ready to use.

Plus, you’ll benefit from some great perks and features:

- Receive unlimited 1% cashback on all purchases

- Access all Visa Commercial card rewards

- Easily manage spending limits

- Monitor transactions in real-time in the Currenxie app

- Create and manage employee cards

On the Fast Track

As part of our card launch, Currenxie has joined the Visa network and Fintech Fast Track Program. Businesses of all sizes will therefore benefit from a card that is secure, easy to manage and linked to the Currenxie Global Account – while supporting their growth by allowing them to make payments for goods and services all around the world.

Of the partnership, Riccardo Capelvenere, Founder and CEO of Currenxie, said: “Our clients are dynamic and they deserve a card to match. We’re proud to have worked with Visa as part of their Fintech Fast Track Program to bring a new type of corporate card to Hong Kong. Today’s launch is an important milestone in achieving our vision of empowering businesses to access global commerce.”

Maaike Steinebach, CEO Hong Kong and Macau at Visa, added: “Innovation in payments is essential to supporting the growth of businesses large and small. As the world’s leader in digital payments, Visa is delighted to partner with Currenxie to develop commercial card solutions. The ease of use, access to global networks and advanced-level security provided by Currenxie’s new Visa card are a powerful combination. Our joint efforts can meet the evolving needs of businesses in dealing with cross-border payments and help optimise their operations.”

From November 1st, the virtual Currenxie Card is available to our Hong Kong clients. Physical cards will be available shortly. We will also soon be rolling out additional multi-user support, to make managing employee card programs more convenient for our clients.

If your business is not registered in Hong Kong, you’ll be glad to know we have plans to bring the card to more countries in the near future.

Apply for your Currenxie Visa Business Card by signing in to your Global Account today!